Advertisement

Advertisement

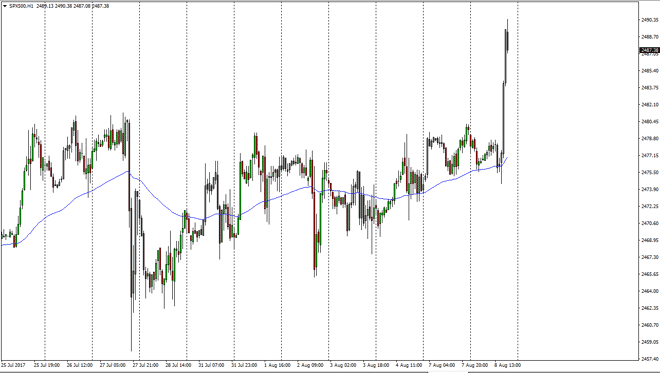

S&P 500 Forecast August 9, 2017, Technical Analysis

Updated: Aug 9, 2017, 05:06 GMT+00:00

The S&P 500 shot higher as Americans got to work on Tuesday, testing the 2490 region. I still think that there is a massive barrier near the 2500

The S&P 500 shot higher as Americans got to work on Tuesday, testing the 2490 region. I still think that there is a massive barrier near the 2500 level, so we will have to see several attempts to break above there. I think pullbacks offer buying opportunities, and certainly you can’t sell this market anytime soon. Ultimately, I think that the market does break to the upside and that should give us an opportunity to be more “buy-and-hold” with this market. I don’t have any interest in selling, I believe that there is more than enough reason to think that we are going to continue to go to the upside. The jobs opening announcement coming out during the day on Tuesday much higher than anticipated it was good for the stock market, as it shows that the US economy is picking up value.

Buying dips

I continue to buy dips, simply because we have more than enough reason to think that the reasonably good earnings season and the strengthening US economy should continue to propel the market to the upside. If we broke down below the 2460 level, that could be very negative, but I don’t think that’s going to happen anytime soon. The market should continue to be volatile, but I think we will eventually find buyers every time we dip, as it offers so much in the way of value in an obvious uptrend. I would have a hard time believing that we should be selling.

S&P 500 Video 09.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement