Advertisement

Advertisement

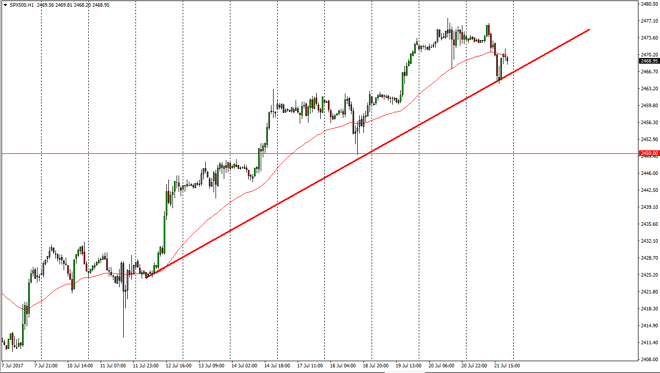

S&P 500 Forecast July 24, 2017, Technical Analysis

Updated: Jul 23, 2017, 07:25 GMT+00:00

The S&P 500 eventually went sideways during the session on Friday, but then fell significantly to reach down towards the 2460 handle. However, we have

The S&P 500 eventually went sideways during the session on Friday, but then fell significantly to reach down towards the 2460 handle. However, we have bounced a bit and I believe that the S&P 500 will continue to benefit from the overall bullish attitude. I believe that we will break out to a fresh, new high, and eventually I think that the market will go looking towards the 2500 level as it is a large, round, psychologically significant barrier. It is a target for the market I think that has been looking for some time. I think that choppiness should continue, but with a significant amount of bullish pressure. I believe that the market should continue to find reasons to go higher, especially considering that the US dollar has been so soft.

EUR/USD

One of the biggest drivers of this market could be found in the EUR/USD pair. With the US dollar falling so significantly against the Euro, it makes sense that people express their opinion in the S&P 500, as a cheaper dollar helps with the profits globally and of course bond markets being bottom brings down interest rates. Quite frankly, stocks are essentially the only game in town for traders. I believe that buying dips continues to be the way going forward, and eventually we will be more of a “buy-and-hold” market, but right now I think the choppiness dictates more buying opportunities on short-term pullbacks and anything else. I have no interest in shorting, and I don’t think most people that I know do either.

S&P 500 Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement