Advertisement

Advertisement

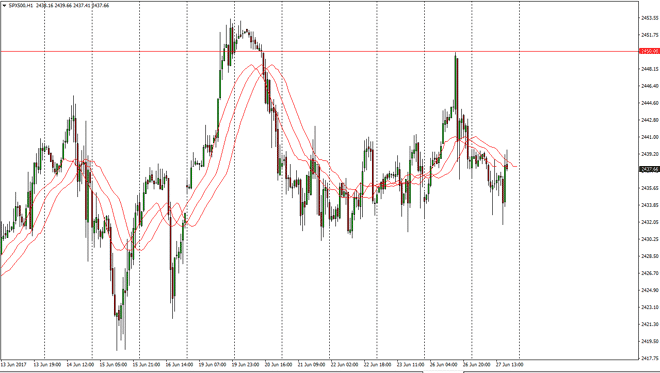

S&P 500 Forecast June 28, 2017, Technical Analysis

Updated: Jun 28, 2017, 05:47 GMT+00:00

The S&P 500 went sideways initially on Tuesday, but then dipped yet again. However, we continue to find support near the 2430 handle, and the market

The S&P 500 went sideways initially on Tuesday, but then dipped yet again. However, we continue to find support near the 2430 handle, and the market rallied towards the 2440 handle. I believe if we can break above the top of the range for the day, the market should then reach to the upside. I believe that the market then goes to the 2450 handle above, where we find even more significant resistance. A break above there should send this market towards the 2500 level given enough time, and that of course is my longer-term target. I believe the dips continue to offer value in a market that has been bullish over the longer-term trends. I believe that the earning season has been decent enough to keep this market afloat, so selling isn’t even a thought.

Buying dips

I continue to buy dips in this market, and I believe that stocks in general will continue to find value hunters. The 2500 level is simply far too important and of course attractive for traders, so I think that the market will find many of reasons to buy when given the opportunity. I think that the market break out to the upside should be a good sign, and will more than likely attract even more value. I believe that the market breaking below the 2430 handle would be a negative sign, and probably have this market looking for the 2400 level underneath which should be the “floor” in the uptrend. With this in mind, I’m a buyer and a buyer only. That doesn’t mean that it won’t be difficult to deal with sometimes, but longer-term I still believe that the buyers run the show when it comes to this index and of course US stock indices in general.

S&P 500 Video 28.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement