Advertisement

Advertisement

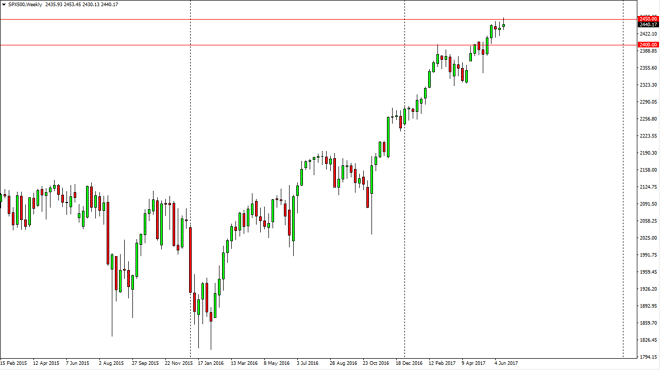

S&P 500 Forecast for the Week of June 26, 2017, Technical Analysis

Updated: Jun 25, 2017, 07:13 GMT+00:00

The S&P 500 initially tried to rally during the week, testing the 2450 handle. However, we pulled back from that level in order to form a shooting

The S&P 500 initially tried to rally during the week, testing the 2450 handle. However, we pulled back from that level in order to form a shooting star. I believe that there is a significant amount of support just below though, so having said that I think that we will eventually go to the upside. Ultimately, if we can break above the top of the shooting star, and of course the 2450 handle, the market should continue to go to the 2500 level. This is a longer-term uptrend, and that being the case I think that pullbacks should offer value that people will be looking to take advantage of, and I believe that the 2400 level underneath should be the bottom of the uptrend.

Recent Rebalancing

Recently, we have seen the market rebalance, and therefore I think the volatility could continue but longer-term I don’t have any interest in shorting. The 2500 level will be far too strong of a target for people to take into account, and I think they will be forced to try and break above it. I do think it will happen, but it will take a significant amount of bullish pressure to finally go higher. I don’t have any interest in shorting the market, I believe that the stronger than anticipated earnings season and of course the lack of interest rates out there should continue to propel this market higher. I also believe that a lot of people don’t believe that the Federal Reserve is going to raise interest rates. However, even though I do, I also recognize that it is a bullish sign that they are even considering it. Selling is all but impossible for what I can see going forward from here.

S&P 500 Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement