Advertisement

Advertisement

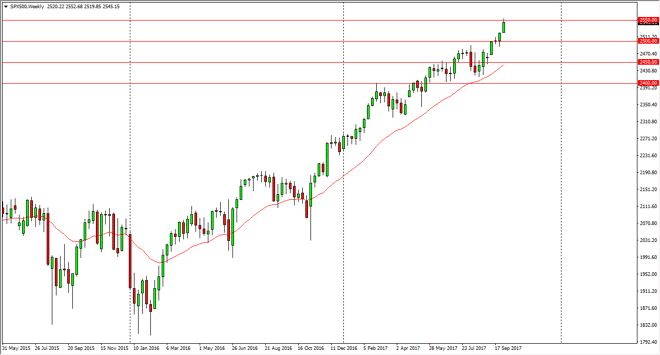

S&P 500 forecast for the week of October 9, 2017, Technical Analysis

Updated: Oct 8, 2017, 07:16 GMT+00:00

The S&P 500 rallied during the week, reaching towards the 2550 handle above. The market looks as if it is going to be resistive, and I think that if

The S&P 500 rallied during the week, reaching towards the 2550 handle above. The market looks as if it is going to be resistive, and I think that if we drop from here, there should be plenty of buying underneath to keep this market going higher. The 2500 level underneath is a previous resistance barrier, so it should not cause a bit of support. The market has been in a strong uptrend, and because of this, I think that selling is all but impossible. Given enough time, I fully anticipate that the buyers will be attracted to dips, and I think that the S&P 500 will continue to lead the way as the stock traders in New York have been rotating out of technology and going into industrials as well as financials. The bank stocks look very healthy, and they have been the main reason why the S&P 500 continues to show such resiliency.

S&P 500 Video 09.10.17

The market has been in a very consistent uptrend, so I think that the market isn’t overdone, although we are starting to see a lot of people complain. When you look at the angle of the uptrend, it is very reasonable and sustainable, so I would not be surprised at all to see a dip early in the week, followed by people going long again. I believe there is plenty of support and value to be found underneath, so until we would break down below the 2400 level, I feel that the uptrend is very much intact and that any negative action now would only value waiting to happen, or perhaps the market catching its breath after the long and sustained run to the upside. Either way, I think that a pullback offers an opportunity for those who are willing to be patient.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement