Advertisement

Advertisement

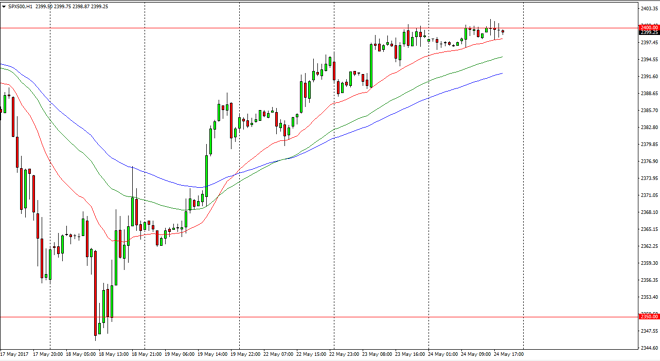

S&P 500 Index Forecast May 25, 2017, Technical Analysis

Updated: May 25, 2017, 03:49 GMT+00:00

The S&P 500 was reasonably quiet during the session on Wednesday as we are approaching a major resistance barrier and of course a large, round,

The S&P 500 was reasonably quiet during the session on Wednesday as we are approaching a major resistance barrier and of course a large, round, psychologically significant number. The market has seen prices as high as 2405, so I think that the market breaking above there is a very strong sign and the market should continue to go to the 2450 handle. This is a market that has wiped out a significant amount of the panic selling that we saw after the Donald Trump and Russia nonsense, so that being the case I think that there is still plenty of bullish pressure underneath. Pullbacks should continue to offer buying opportunities, and as you can see the red 24 hour exponential moving average has offered dynamic support for the last 3 days. Ultimately, selling is all but impossible because of the various support levels underneath.

Long only

I think that we are trying to build up enough momentum to finally break out and go higher, with a longer-term target of 2500 for me. However, I recognize that we are fighting against a “wall of worry” as is typical of stock markets. Ultimately, the market should continue to find buyers on dips so I have no interest in selling. I think every time we pull back, it is going to be simple value that market participants can take advantage of. We have seen this time and time again, and I don’t think that’s going to change anytime soon. At current levels, it might be best to wait for a little bit of a pull back, unless of course we get the breakout above the 2405 level that the market has been struggling with. Selling is all but impossible at this point, and will turn out to be a fool’s errand.

S&P 500 Video 25.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement