Advertisement

Advertisement

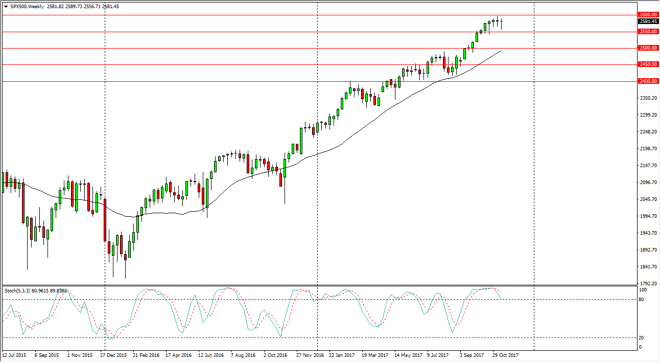

S&P 500 Index Forecast for the Week of November 20, 2017, Technical Analysis

Updated: Nov 19, 2017, 08:31 GMT+00:00

The S&P 500 fell during the week but found enough support at the 2550 level to turn around and form a hammer. The hammer, of course, is a bullish

The S&P 500 fell during the week but found enough support at the 2550 level to turn around and form a hammer. The hammer, of course, is a bullish sign, and we continue to form them just above the 2500 level. While this market is overextended by just about every metric I use, not to mention the fact that the stochastic oscillator has crossed over in the overbought condition, it’s become obvious that the 2550 level is a major support level. When markets reach this type of overextension, one of 2 things will typically happen: we would either pull back significantly to find enough value to go long again, or we will go sideways for a while. Recently, it’s become a bit obvious that a pullback is going to be difficult to get. I think the market may continue to go sideways in general.

S&P 500 Video 20.11.17

If we do break down below the 2550 handle, I suspect that the 2500 level underneath is even more supportive. Because of that, it’s likely that we will see buyers in that area on a breakdown, and the longer-term trader would be well served to step out of the way and let the support work its magic. Alternately, if we break above the 2600 level, it’s time to start buying again as well. This market has been overdone, but longer-term traders will not be interested in selling, as the risk to reward ratio simply won’t be there. Earnings season has been good, so that might continue to lift this market, and if the US dollar continues to fall, that might help as well. I also get the feeling that most traders are simply waiting for the US Congress to finally pass a tax bill, which should send stocks much higher.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement