Advertisement

Advertisement

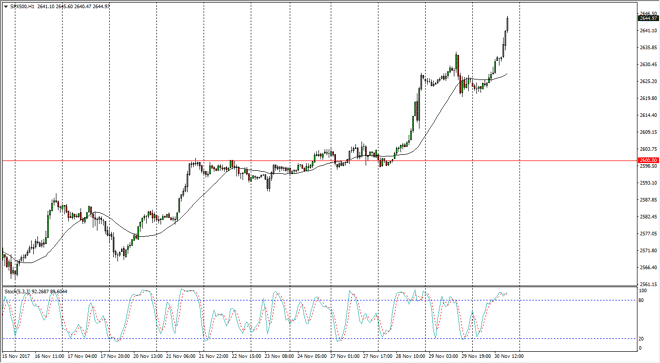

S&P 500 Index Price Forecast December 1, 2017, Technical Analysis

Updated: Dec 1, 2017, 04:11 GMT+00:00

With the stock markets in America rallying yet again, it looks as if we are entering a bit of an overbought condition, so finding value is going to be paramount.

The S&P 500 has shot higher during the trading session on Thursday, reaching towards the 2650 handle. The stochastic oscillator has crossed over in the overbought section of the indicator, so it looks very likely that we could get a short-term pullback. The 2635 level underneath could be the beginning of significant support, and I believe that the market participants are waiting for value to jump in. At this point though, we are overbought, and I think it would be very difficult to take advantage of this uptrend, as the easiest way that I can think of the lose money is to chase a trade. Buying at this high level would be doing exactly that.

Short-term pullbacks should offer the value that we are looking for, and I believe that the 2650 level is going to be a psychological barrier that is difficult to overcome and the short-term, but longer-term I don’t see any reason why we wouldn’t do that. I believe that there is a hard “floor” in the market at the 2600 level underneath, so given enough time I’m looking for some type of bounce or supportive candle to take advantage of. In general, this is a market that should find plenty of volatility in value underneath, but I think that the main driver of the S&P 500 over the next several weeks will be the so-called “Santa Claus rally.” Historically, as we closer to Christmas, as it’s normally a good time of year as fund managers will trying to put money into the market to show their clients if they are in fact doing something. Any fund that has underperformed during the last 11 months is chasing money at this point. Therefore, I think we will continue to see rallies after negativity creeps into the market.

S&P 500 Video 01.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement