Advertisement

Advertisement

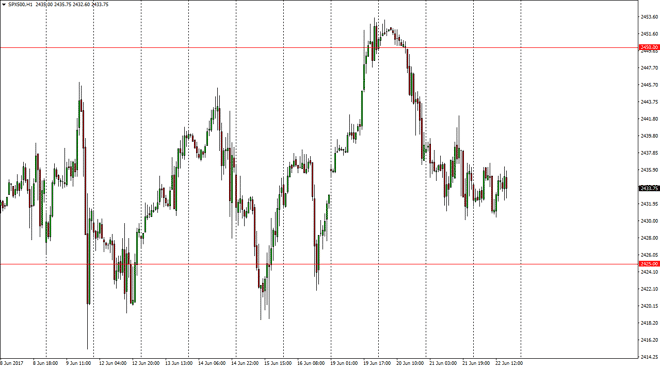

S&P 500 Index Price Forecast June 23, 2017, Technical Analysis

Updated: Jun 23, 2017, 03:42 GMT+00:00

The S&P 500 had a sideways session during the day on Thursday, as we continue to find support near the 2425 handle. I believe that ultimately this

The S&P 500 had a sideways session during the day on Thursday, as we continue to find support near the 2425 handle. I believe that ultimately this market will rally, because quite frankly it is a strong uptrend that we have been in. However, there’s not much to move the market currently, so I think that the buyers are essentially taking a bit of a break and we could perhaps be entering an accumulation phase. This happens quite a bit when market selloff in a strong uptrend, but eventually there will be reason enough to start buying again. I think that the “smart money” will continue to accumulate position as we go higher. A break above the 2440 handle census market looking for the 2450 level, and then break above there to the 2500 level.

Longer-term uptrend

Remember, it’s a longer-term uptrend that we are in, so therefore I think that the 2450 handle is more than likely going to be resistance, but once we break above there I think that we will reach towards the 2500 level rather quickly. That level will be a significant amount of resistance, because it is a large, round, psychologically significant number. A break above there of course is a longer-term “buy-and-hold” signal, but I don’t think we’re going to see that in the next 30 days or so. I think we are going to continue to see a lot of volatility, but I still have an upward bias, and believe that the Americans will continue to push the index higher. Ultimately, pullbacks are value opportunities just waiting to happen, but the buyers will have to be patient, it will take a significant amount of diligence to make money in this market place, and it is times like this that you will have to stick to your guns.

S&P 500 Video 23.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement