Advertisement

Advertisement

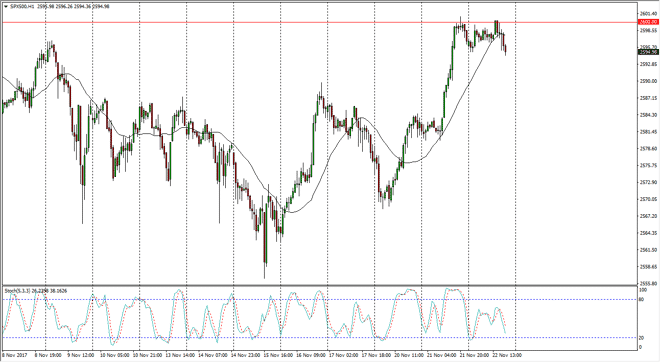

S&P 500 Index Price Forecast November 23, 2017, Technical Analysis

Updated: Nov 23, 2017, 05:02 GMT+00:00

The S&P 500 continues to be very choppy, sitting just below the 2600 level as the market may have gotten ahead of itself. It looks as if we are

The S&P 500 continues to be very choppy, sitting just below the 2600 level as the market may have gotten ahead of itself. It looks as if we are getting a bit of support near the 2595 handle, but ultimately, I think that staying away from this market is all that you can do. Thanksgiving is today, and any movement in the CFD market might be reflective of electronic futures trading, but quite frankly will have very little to do with reality. I think that given enough time, the market is going to break above the 2600 level, as we are starting to see momentum build up to the upside, and a break above that level should send this market towards the 2625 handle, possibly the 2650 level after that.

In the meantime, I think the pullbacks are likely, and that the 2580 level should offer support. Quite frankly, I would love to see the CFD market break down during the holiday, thereby causing some type of inefficiency that I can take advantage of. I would be a buyer on any surge lower, but that is very unlikely to happen. With this being the case, it’s probably best to stay away from the S&P 500 until Monday, as the best indicator at that point will be what’s going on in both Europe and Asia. Typically, it looks as if the S&P 500 will follow the lead of the DAX, and of course geopolitical headlines. It can be difficult to gauge what to do next based upon that until we get some feedback from European indices. In general, pay attention to the US dollar as well, as if it starts to fall significantly, we should see bullish pressure in this market as well.

S&P 500 Video 23.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement