Advertisement

Advertisement

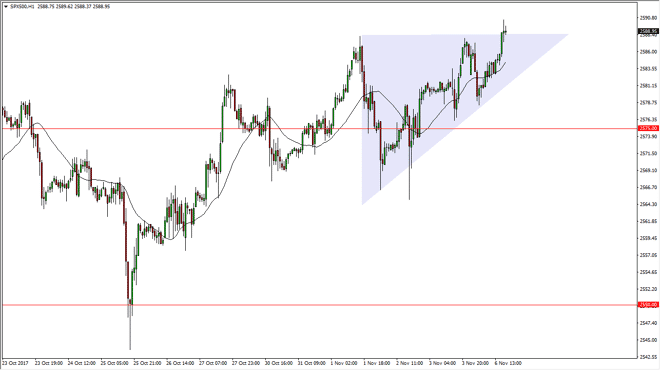

S&P 500 Index Price Forecast November 7, 2017, Technical Analysis

Updated: Nov 7, 2017, 08:21 GMT+00:00

The S&P 500 has rallied yet again during the session on Monday, breaking to a fresh, new high. It looks like we are trying to get above the 2600 level

The S&P 500 has rallied yet again during the session on Monday, breaking to a fresh, new high. It looks like we are trying to get above the 2600 level eventually, and a move above that should send this market even higher. However, I think that pullbacks will be buying opportunities, and that’s probably what we will see in the meantime as it will take a significant amount of momentum building to break out. I look to buy on the dips, and it certainly looks as if we will get those opportunities below. The 24-hour exponential moving average is turning higher, showing that we continue to find reasons to go long. The pseudo-ascending triangle that I have drawn on the chart also suggests that we are going to see a move to roughly 2615, and I think that given enough time it’s likely that the algorithmic traders continue to come back into the market and pick up the S&P 500 any time it sells off.

S&P 500 Video 07.11.17

If we were to break down from here, the 2575 level underneath will be supportive, and essentially act as a “floor” in the market. If we were to break down below there, that would be significant, perhaps send in the market down to the 2550 level over the longer term. In general, it’s likely that we will continue to see buyers jumping in, and I think that the longer-term uptrend is most certainly intact in the S&P 500, as it is in most equity markets that I follow. Stock markets continue to be fueled by cheap money, and that has not changed at all. In fact, the ECB has just announced that they were extending to money, and the Bank of England has cooled expectations as to future interest rate hikes.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement