Advertisement

Advertisement

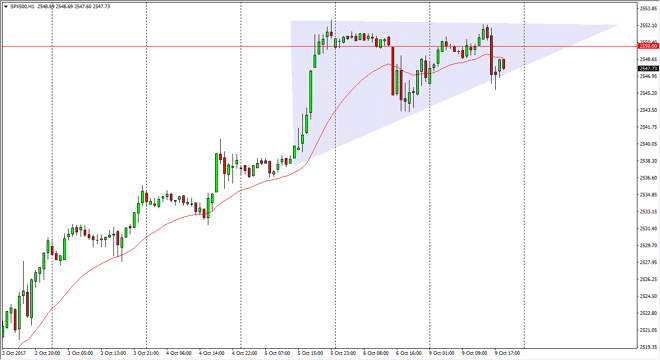

S&P 500 Index Price Forecast October 10, 2017, Technical Analysis

Updated: Oct 10, 2017, 07:17 GMT+00:00

The S&P 500 had a volatile session on Monday, reaching towards the 2550 handle. I believe that the market continues to bounce around in this general

The S&P 500 had a volatile session on Monday, reaching towards the 2550 handle. I believe that the market continues to bounce around in this general vicinity, and the potential ascending triangle that is forming on the hourly chart suggests that we could get a bit of buying pressure. If we can break out to a fresh, new high, the market should then go towards the 2600 level above. I think that the market continues to see noisy action, as we have gotten a bit ahead of ourselves as of late. I think that every time we pull back though, there will be buyers looking to get involved in what has been one of the more bullish markets that I follow.

Ultimately, I believe that the 2500 level underneath is the “floor” in the market, and that should keep the uptrend intact. If we were to break down below the 2500 level, the market would suddenly lose the uptrend, and that could send this market much lower. However, I don’t think that happens, so I think that the market continues to find reasons to go higher over the longer term. The overall attitude of the market remains positive because quite frankly central banks continue to liquidate the markets. I think that we will go to the 2600 level above, and perhaps even higher than that, with a longer-term target of 2750 or so.

S&P 500 Video 10.10.17

Ultimately, I think the stock markets, in general, are going to continue to be bullish, but you may have to look for dips and value in a market that continues to overextend itself. While we have gone a bit higher than I thought we would in the short term, quite frankly you cannot bet against this market in this state.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement