Advertisement

Advertisement

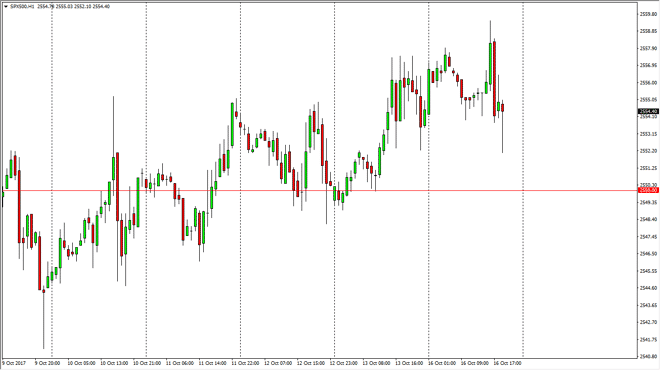

S&P 500 Index Price Forecast October 17, 2017, Technical Analysis

Updated: Oct 17, 2017, 07:21 GMT+00:00

The S&P 500 fell significantly during the day on Monday after initially trying to rally. However, we turned around to show signs of life again, as the

The S&P 500 fell significantly during the day on Monday after initially trying to rally. However, we turned around to show signs of life again, as the 2550 level continues to be a bit of a floor. I think that the S&P 500 will go looking towards the 2600 level above, and that will be the target. I think that every time we dip, you should start looking for value in a market that has been very bullish over the longer term. I think that the market should continue to go towards the upside and the earnings season coming out currently, I think that the markets will continue to be very volatile, and of course favorable.

S&P 500 Video 17.10.17

The 2550 level underneath should continue to be supportive, and the 2500 level underneath there should continue to be the absolute “floor” in the market, and of course, the uptrend is still very much intact as long as we can stay above that level. Ultimately, this is a market that should continue to be favored overall as the US stock market has been healthy, and has recently been making fresh, new highs repeatedly. Ultimately, this is a market that I think will go looking towards higher levels and that many traders out there are concerned about missing out on the trade. Although we are a bit overdone, the likelihood of the market selling off with any significant seems to be very small. I believe that the S&P 500 will continue to be a leader when it comes to the stock markets in America, especially considering that financials are doing reasonably well. With that being the case, I think that adding to a longer-term core position on dips continues to be the best way to play the S&P 500, as well as other US stock indices.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement