Advertisement

Advertisement

S&P 500 Price Forecast January 9, 2018, Technical Analysis

Updated: Jan 9, 2018, 03:14 GMT+00:00

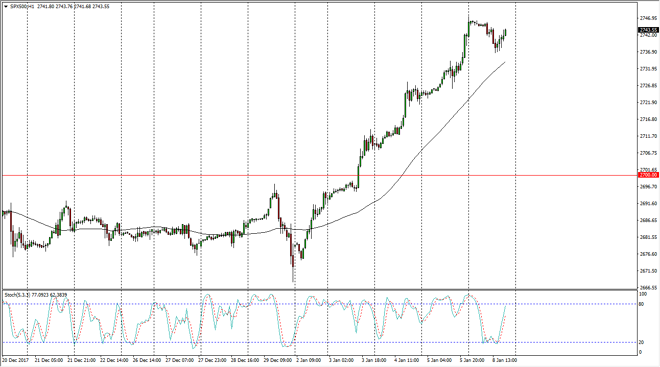

S&P 500 traders initially did very little during the day on Monday, but then drifted down towards the 2730 region. We did eventually bounce from there, continue in the uptrend overall. Ultimately, I believe that the market should continue to be bullish, but of course we will have the occasional noisy move.

The S&P 500 drifted sideways initially during the day on Monday, but to as the Americans came back to work, they started to sell off the S&P 500. We found enough support near the 2730 level to turn things around and rally again though, so it looks likely that we will see buyers continue to push this market to the upside. The 2750 level is a target, but I think a short-term one. Longer-term, we go much higher, perhaps reaching towards the 2800 level, 2900 level, and eventually the 3000 level by the end of the year.

Even if we break down significantly from here, I believe there is more than enough support at the 2700 level to keep the uptrend intact. After the tax bill being passed, it makes sense that we will continue to see bullish pressure in the S&P 500 as traders in America start to focus on the extended gains that large companies are going to make, especially if they have the ability to bring money overseas back home. It’s obvious to me that money managers have come back to work and started putting money in play, and I think that is going to continue to be the theme, least in the foreseeable future. I have no interest in shorting this market until we are well below the 2700 level, and that doesn’t look like something that’s going to happen anytime soon from what I see on the chart.

S&P 500 Video 09.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement