Advertisement

Advertisement

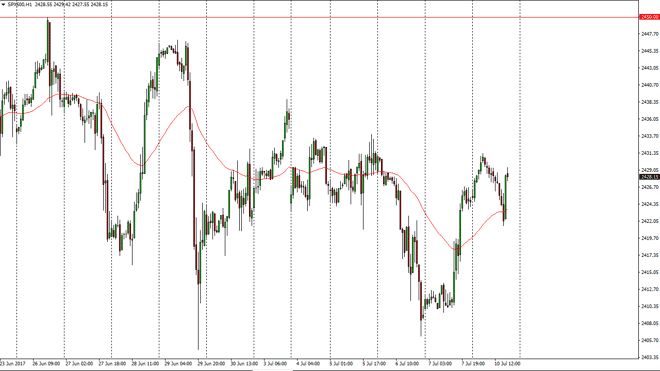

S&P 500 Price Forecast July 11, 2017, Technical Analysis

Updated: Jul 11, 2017, 05:46 GMT+00:00

The S&P 500 initially tried to rally during the day on Monday, and then fell significantly to reach towards the 2420 handle. We bounced from there

The S&P 500 initially tried to rally during the day on Monday, and then fell significantly to reach towards the 2420 handle. We bounced from there though, as we continue to see a lot of volatility. This is the beginning of earnings season, so expect a lot of noise, and that of course will continue to be a situation that could cause volatility. I think that longer-term we do have an underlying bias to go to the upside, so dips could be buying opportunities. With financials reporting early this week, that should give us an opportunity to continue towards the 2450 level. If we break above there, then the market goes much higher.

2400

I believe that the 2400 level is massively supportive, and as long as we can stay above there I have no interest in shorting. You can see the Friday was very bullish, and we are starting to see a continuation of that on the hourly chart. I don’t know if we can break above 2450 and the short-term, but I do think it happens over the longer term. Because of this, we may need to make several attempts to finally go long and going towards the 2500 level above. The 2500 level above is a major barrier to overcome, and because of this it’s likely that the market is going to have to attempt the break out several different times. Resiliency will pay off, just as buying on the dips should. It appears that the Americans are more interested in buying this market and Europeans, so keep in mind that most of the bullishness may be during North American trading hours, which of course makes a lot of sense as the headlines will cross the wires during these hours anyway.

S&P 500 Video 11.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement