Advertisement

Advertisement

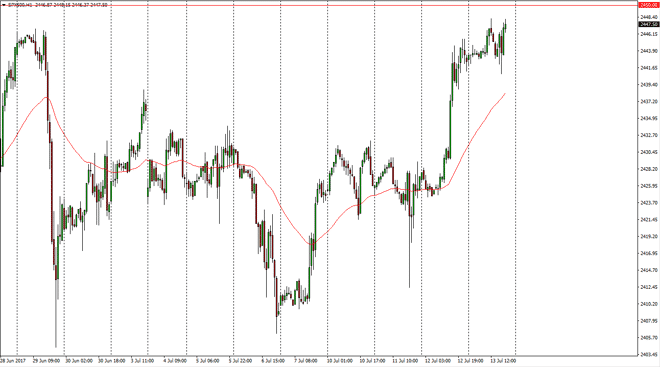

S&P 500 Price Forecast July 14, 2017, Technical Analysis

Updated: Jul 14, 2017, 05:30 GMT+00:00

The S&P 500 had a choppy session on Thursday as Janet Yellen spoke in front of Congress. The market is approaching the 2450 handle, which seems to be

The S&P 500 had a choppy session on Thursday as Janet Yellen spoke in front of Congress. The market is approaching the 2450 handle, which seems to be very resistant. I think if we can break above there, the market continues to go much higher, perhaps reaching towards the 2500 level. Pullbacks at this point should find buyers, and I believe that the 2440 level is the first support level. Because of this, I continue to buy dips, as this market should continue to find reasons to go higher, and with the earnings season going on right now it’s likely that the market will look to that series of announcements to take advantage of value on the pullbacks.

The Federal Reserve

The Federal Reserve has a lot to do with what’s going on in this market right now, because Janet Yellen has suggested that they are going to normalize rates in a much shallower manner than originally thought, and more importantly: much slower. I think this is good news for the markets, as they look forward to earnings, and that is the next move. Looking at the Wednesday session, we sliced through to the upside, and that impulsivity should continue to be reason enough to get involved in this market. I believe that once we break above the 2450 handle, we will of course approach that 2500 level, but I like buying dips when we get that opportunity. Once we break above 2500, we start the next leg higher, and that is a longer-term “buy-and-hold” type of situation. Currently, I have no interest in selling this market, as I believe the 2400 level underneath is the “floor” in the market. Ultimately, this is a market that has a massive amount of bullish pressure in it, and I think will continue to look bullish.

S&P 500 Video 14.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement