Advertisement

Advertisement

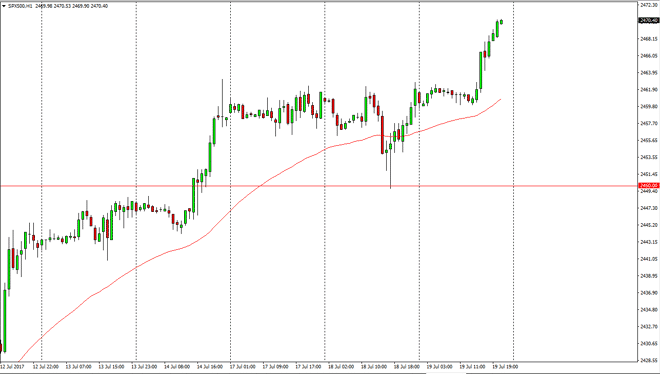

S&P 500 Price Forecast July 20, 2017, Technical Analysis

Updated: Jul 20, 2017, 06:22 GMT+00:00

The S&P 500 went sideways initially during the day on Wednesday, then shot through the 2460 handle rather handily. It’s very likely that the market

The S&P 500 went sideways initially during the day on Wednesday, then shot through the 2460 handle rather handily. It’s very likely that the market will continue to go towards the 2500 level, which is my longer-term target. I believe that short-term pullbacks will be buying opportunities, as the uptrend is very strong. I believe that the market will target 2500 which has been my longer-term target, and I believe that if we can finally break above there, the market will continue to go much higher. I think it will take several attempts though, and therefore I think that a “buy on the dips” type of mentality is probably what we are going to continue to see in the S&P 500, and the US stock indices in general.

Earnings season

We are in the middle of the earnings season, which of course can be very influential as to where we go next in the stock markets in America. I believe that pullbacks will continue to offer value the people are willing to take advantage of, because quite frankly this rally refuses to die, and if corporate earnings and that being strong, that will only add more fuel to the fire. Wall Street is now starting to bet that the Federal Reserve won’t be able to raise interest rates, or at least not as strong as once thought. Because of this, I believe that there is still plenty of reason to think that the stock market rally in America continues, and of course that will be any different in the S&P 500, as it is one of the most major benchmarks that we follow. Selling isn’t even a thought, so therefore I look at it as value presented itself in a market that is so obviously bullish.

S&P 500 Video 20.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement