Advertisement

Advertisement

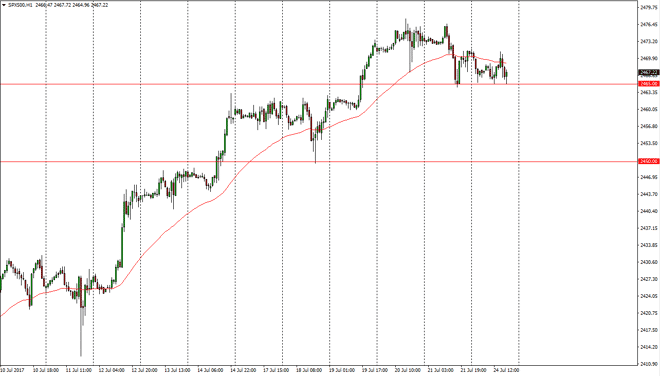

S&P 500 Price Forecast July 25, 2017, Technical Analysis

Updated: Jul 25, 2017, 04:15 GMT+00:00

The S&P 500 initially fell on Monday, but continue to find support near the 2465 handle. Because of this, I think the market will bounce eventually,

The S&P 500 initially fell on Monday, but continue to find support near the 2465 handle. Because of this, I think the market will bounce eventually, as this is an area that should be well supported. I think that the market will probably go looking towards the 2470 handle, and then the 2475 handle. Remember, we are in the busiest week of earnings season for the S&P 500, so headlines will continue to bash this market about. Given enough time, I do believe that the buyers come back, and I do believe that the S&P 500 retains its bullish tone. With a sudden emphasis on the Federal Reserve looking a little less hawkish than previous, it’s likely that stock markets will continue to feed on the liquidity frenzy that we continue to see.

Ultimately, I’m a buyer of dips

I’m a believer that this market will continue a “buy on the dips attitude, and therefore I look to them as value propositions. Market participants seem to be willing to come back to the market anytime there is a selloff, and that has not changed yet. Quite frankly, this is one of those things that you should look at as a “it will work until it doesn’t” type of situation. Currently, looks as if the Americans are willing to step in and pick up stocks every time they look cheap. Quite frankly, every time a selloff, they look cheap. I believe that the S&P 500 will continue to reach towards my longer-term target of 2500. I have no interest in selling, least not until we break below the 2450 handle, something that doesn’t look very likely to happen anytime soon. Buyers continue to show more resiliency than the sellers, so therefore I’m willing to side with them.

S&P 500 Video 25.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement