Advertisement

Advertisement

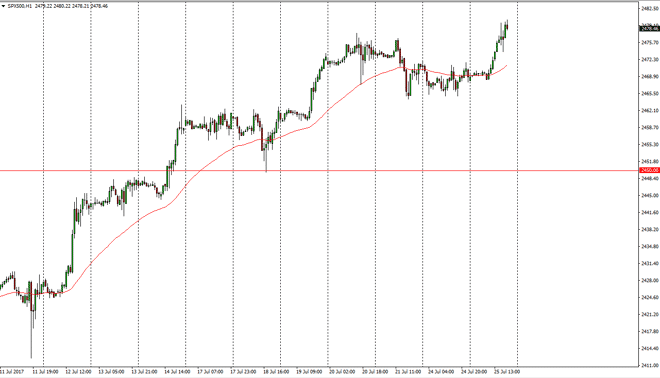

S&P 500 Price Forecast July 26, 2017, Technical Analysis

Updated: Jul 26, 2017, 04:42 GMT+00:00

US stock indices in general had a very strong session on Tuesday, as we have broken out to fresh new highs. The S&P 500 breaking towards the 2480

US stock indices in general had a very strong session on Tuesday, as we have broken out to fresh new highs. The S&P 500 breaking towards the 2480 level was no exception, and I think that the impulsive move, although perhaps a little bit overdone, will continue pending what happens with the FOMC. I think that the interest rate statement and of course the general outlook of the FOMC will have a massive effect on this market, but even beyond that, I believe that the bullish pressure continues for several different reasons.

One-way trade?

If we get a bullish statement coming out of the FOMC, it is likely to be good for the US dollar. That could have a short-term negative effect on the S&P 500 as it could affect global earnings, but at the end of the day it also means that the Federal Reserve thinks that the economy is improving, and that of course is going to be good for the stock market longer term. If we get a hockey statement coming out of the FOMC or even an interest rate high, I would expect a knee-jerk reaction to the downside. However, that should end up being a buying opportunity, as we are in a strong uptrend for several different reasons, not the least of which would be good earnings. We are in the middle of earnings season, so there are a lot of noise is out there that could affect the market. In the way, I am a “buy on the dips” type of traitor in general, and have no interest in shorting the S&P 500 until we break down below the 2450 handle, and more importantly, the 2400 level which doesn’t look very likely happen anytime soon.

S&P 500 Video 26.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement