Advertisement

Advertisement

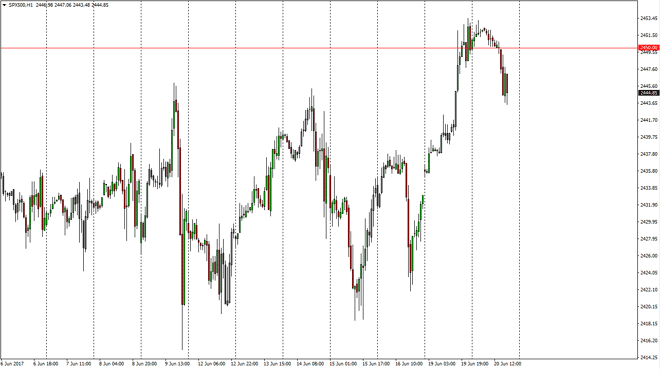

S&P 500 Price Forecast June 21, 2017, Technical Analysis

Updated: Jun 21, 2017, 04:40 GMT+00:00

The S&P 500 fell slightly during the course of the session on Tuesday, slicing below the 2450 handle. The market slicing below that level is a

The S&P 500 fell slightly during the course of the session on Tuesday, slicing below the 2450 handle. The market slicing below that level is a slightly negative sign, but the 2440 level underneath should offer quite a bit of support. I believe that the market will eventually go to the upside as we have seen so much bullish pressure in the S&P 500, and I think that the market should then go towards the 2500 level after that. This is a market that continues to favor the upside due to the better than anticipated earnings season that we have seen, and of course the strengthening US economy. I believe that the market and is going to continue to favor the upside on dips, and that is a market that is a longer-term buying opportunity, and dips offer value. A break higher should send this market looking towards the 2500 level over the longer-term, and I believe that area will cause quite a bit of resistance but given enough time I feel that the buyers will find another reason to break above there.

No interest in selling

I have no interest in selling this market, because quite frankly I feel that the previous impulsive move will continue to offer a barrier for the sellers that they will be able to overcome. The market will more than likely continue to be choppy, but it certainly seems to favor the upside. I think that the volatility will shake the weaker players out, but longer term “smart money” seems to be rather insistent on hanging on to the upside, and with that being the case I intend on following those orders.

S&P 500 Video 21.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement