Advertisement

Advertisement

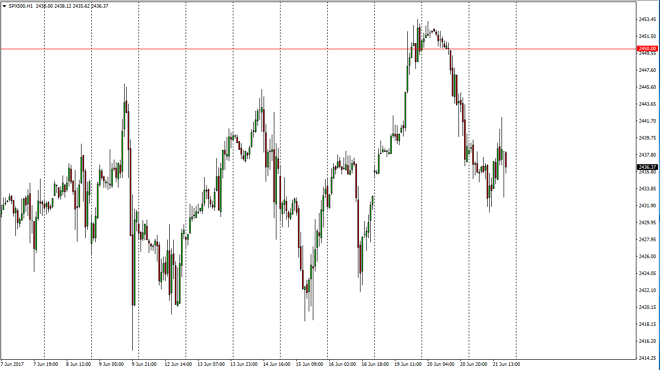

S&P 500 Price Forecast June 22, 2017, Technical Analysis

Updated: Jun 22, 2017, 04:44 GMT+00:00

The S&P 500 had an extraordinarily volatile session during the day on Wednesday, as the market continues to show trouble. This being the case, the

The S&P 500 had an extraordinarily volatile session during the day on Wednesday, as the market continues to show trouble. This being the case, the market looks like it is finding support at the previous gap near the 2430 handle, but obviously there are a lot of headlines moving things around rapidly. If we can break above the 2440 handle, I feel the market then should go to the 2450 handle at that point. I break above that level should send this market even higher, as the 2500 level would be targeted then. I believe that the market continues to be a “buy on the dips” situation, but it’s very likely that small positions will be needed to take advantage of this market. I believe that given enough time, the market will not only reach towards the 2500 level, but break above there.

The alternate scenario

If we breakdown below the 2400 level underneath, that would be a very negative sign, and for me kills the uptrend, at least in the short term. I believe that the market will continue to be very volatile, but the filling of the gap is a significant technical side of a potential turn around to the upside, so I think that it’s only matter of time before the buyers get involved. The S&P 500 has been very strong historically, and recently it looks as if we are trying to move into a higher consolidation area, as the market should continue to find plenty of reason to jump around, as earnings have been good, but we continue to see a lot of concern in general.

S&P 500 Video 22.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement