Advertisement

Advertisement

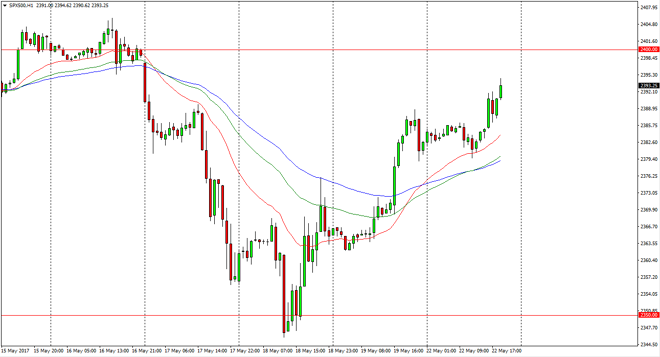

S&P 500 Price Forecast May 23, 2017, Technical Analysis

Updated: May 23, 2017, 06:07 GMT+00:00

The S&P 500 was relatively flat during most of the session on Monday, but then shot higher as it looks like we are trying to reach towards the 2400

The S&P 500 was relatively flat during most of the session on Monday, but then shot higher as it looks like we are trying to reach towards the 2400 level. Pullbacks at this point should be thought of as value, as we have broken above a minor resistance barrier in the form of the 2390 handle. Because of this, I look at pullbacks that form supportive candles as value, as the market I believe will make an attempt to break above the 2400 level again. Stocks have all but left the drama in Washington DC behind, so what was once thought of as a potential major turning of been in the momentum of the stock market now looks to be yet another buying opportunity in what has been a very bullish run.

With that in mind, I’m buying dips…

With all that in mind, I buying dips as the uptrend is most certainly strong, and trying to find what we have seen over the last several months would be rather foolish. I think that once we can break above the 2405 level, the market can go much higher. It may take several attempts to get above there, but I believe that’s the ultimate barometer of strength. I believe that the 2385 level underneath is where the core of the support is in the short term, and with the moving averages all crossing each other again on my hourly chart, this tells me that the buyers are starting to take control.

The selloff that we had seen last week was rather brutal, but at the end of the day, the President’s problems have little to do with earnings and those were relatively strong. With that being the case, I believe that the S&P 500 continues to be a bullish market that trades in one direction over the longer term: up.

S&P 500 Video 23.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement