Advertisement

Advertisement

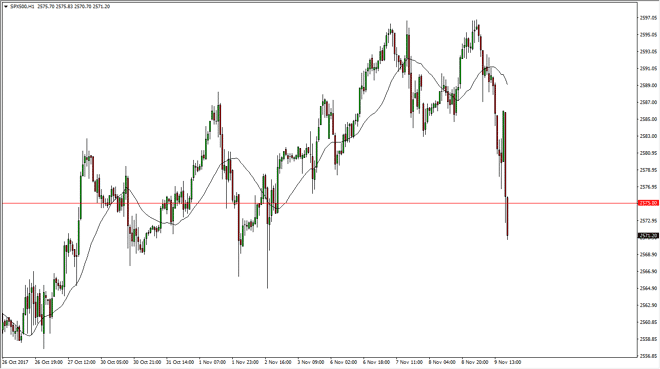

S&P 500 Price Forecast November 10, 2017, Technical Analysis

Updated: Nov 10, 2017, 04:35 GMT+00:00

The S&P 500 fell hard during the trading session on Thursday, as word got out that the tax reform may be pushed back farther than anticipated, and as

The S&P 500 fell hard during the trading session on Thursday, as word got out that the tax reform may be pushed back farther than anticipated, and as with all things tax reform related, the market seems to be hinging on it. I think that breaking through the 2575 handle was indeed important, and I also think that we will continue to go little bit lower. Quite frankly, this is welcome news as we have gotten far ahead of ourselves, and the market is overextended. When the markets get this hot, it tends to attract a lot of “scared money”, and I think that the traders that get involved in that area are jumping out as they are afraid of catching the top of the market, something that’s very possible considering how far we had gone. However, I think that it’s only a matter of time before the buyers return, based upon algorithmic trading. However, it is certainly a good time to stay away from the market, and cheer for lower levels, as it gives you value that is so desperately needed.

At this point, it’s probably best to stay away and wait until Monday, which not only gives us the entire 24 hours for today to see how things shake out, it also gives us new information over the weekend when it comes to the tax bill, and the fight in Washington DC when it comes to that crucial piece of legislation. Because of this, I have no interest in trading this market, but I think that eventually we should get a nice longer-term opportunity. The selloff has been rather brutal during the trading session on Thursday, and quite often this signals just how tenuous the situation is even if we do rally.

S&P 500 Video 10.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement