Advertisement

Advertisement

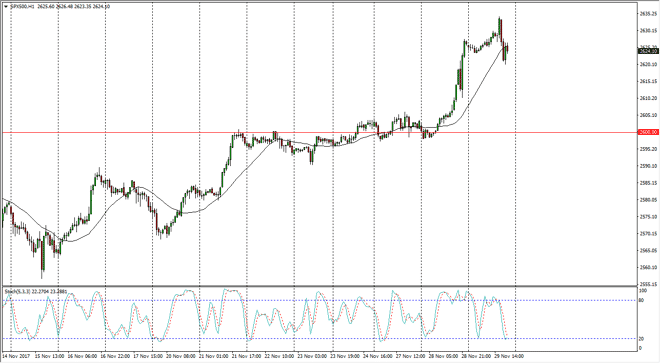

S&P 500 Price Forecast November 30, 2017, Technical Analysis

Updated: Nov 30, 2017, 05:06 GMT+00:00

The S&P 500 initially went sideways during trading on Wednesday, but trying to rally, only to fail and pull back from the 2630 handle. Because of

The S&P 500 initially went sideways during trading on Wednesday, but trying to rally, only to fail and pull back from the 2630 handle. Because of this, the market looks likely to continue to see a lot of volatility in the 2625 range, and I think that the market will eventually find buyers though. We are crossing over on the stochastic oscillator on the hourly chart, suggesting that buyers are coming back into the marketplace. I think the 2600 level continues to be an area where buyers will be interested in picking up value, so I look at pullbacks as potential buying opportunities in a market that has been strong for some time.

However, if we pulled back below the 2600 level, I think at that point the sellers will probably get involved and continue to push the S&P 500 down towards the 2550 level which was also very important in the past. I think that the markets will continue to be bullish in general, but if we do get more negative pressure, a lot of scared money could go running. As things stand now though, I am more than willing to buy dips in a market that continues to show plenty of momentum to the upside. Ultimately, this is a market that I think goes looking towards the 2750 level, and right now it looks very likely that people will continue to find value every time it drops. After all, central banks continue to flood the markets with liquidity, even though interest rates may go higher in the future. Nonetheless, that is already known by market participants, so with that, I believe that we will continue to see money flowing towards Wall Street. While stocks are overvalued, there’s no sign of a significant reversal.

S&P 500 Video 30.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement