Advertisement

Advertisement

S&P 500 Price Forecast October 13, 2017, Technical Analysis

Updated: Oct 13, 2017, 05:43 GMT+00:00

The S&P 500 initially fell on Thursday, reaching down towards the 2550 handle. That’s an area where we have seen interest in the past, so it makes

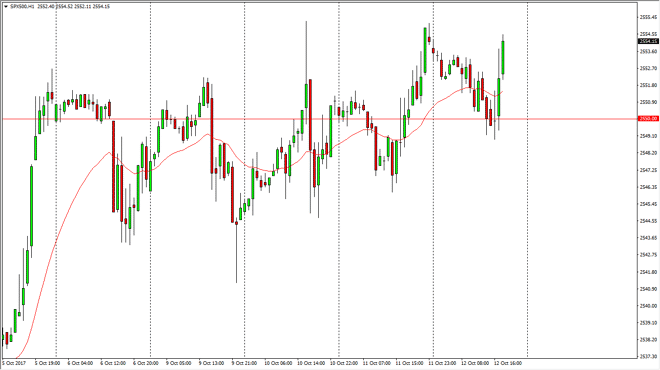

The S&P 500 initially fell on Thursday, reaching down towards the 2550 handle. That’s an area where we have seen interest in the past, so it makes sense that we bounce from there. This was especially true after J.P. Morgan and Citigroup both presented strong earnings, and therefore sent money flying into the S&P 500 as financials are a major portion of the market. I don’t have any interest in shorting this market, mainly because as you look at it, there seems to be increasing pressure every time we dip. We continue to make “higher lows”, so it makes sense that there will continue to be interest by the public to go long. I think that the market will continue to show volatility, but I think it’s only a matter of time before we continue to go higher, perhaps reaching towards the 2600 level next.

As you can see on the hourly chart, the 24-hour exponential moving average is tilling to the upside, and slicing right through the middle of the overall action. I think this suggests that we are going to continue to see buyers, and if the 2450 level underneath should continue to be attractive to traders, we are going to continue to see more reason to go long. I like the S&P 500 overall, as money had previously been falling out of favor with the technology stocks, and flooding into the financials. With interest rates rising, it’s very likely that banks will continue to lead the S&P 500 as they are a vital part of the market trying to go higher. The volatility should continue, but I think that the overall trend is very much intact, and that should continue to offer plenty of opportunity. Selling isn’t even a thought.

S&P 500 Video 13.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement