Advertisement

Advertisement

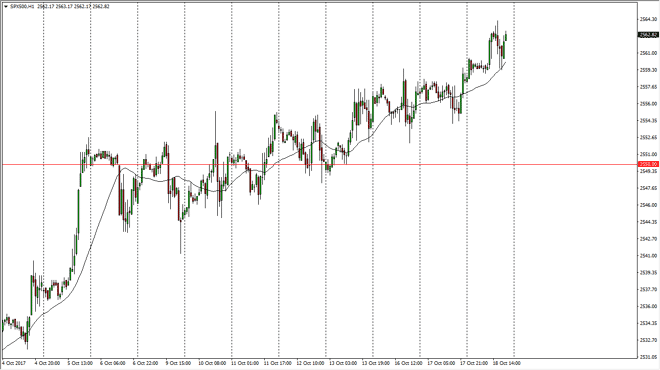

S&P 500 Price Forecast October 19, 2017, Technical Analysis

Updated: Oct 19, 2017, 07:30 GMT+00:00

The S&P 500 went sideways initially during the session on Wednesday, testing the 2555 handle. That level offer plenty of support, and it looks likely

The S&P 500 went sideways initially during the session on Wednesday, testing the 2555 handle. That level offer plenty of support, and it looks likely that the market rallying to the 2565 level was the first sign that the buyers are coming back, and now as I record this video, I recognize that the 2565 level above being broken to the upside should have more money flowing into this market. Nonetheless, the 24-hour exponential moving average has offered support as well, so I think it’s likely that we will continue to find buyers. The 24-hour exponential moving average is showing that the buyers are starting to pick up steam and that the 2550 level should now offer a bit of a floor.

S&P 500 Video 19.10.17

Ultimately, the market should then go to the 2600 level above, which of course will offer a bit of resistance due to the large, round, psychologically significant number. Also, keep in mind that this is earnings season, and that, of course, can cause a lot of volatility in the S&P 500. Ultimately, the market is a “buy on the dips” type of situation, and I think that given enough time, the market will probably go towards the 3000 level, but that’s obviously something to see next year, not anytime soon. If we were to break down below the 2540 level, that would be a negative sign, and that could send this market to much lower levels. But until then, it seems likely that the overall attitude of the market should continue to be positive, and I think that dips offer value that people will be taken advantage of. Longer-term, buying on the dips and then adding on each subsequent dip could be the way to go as well.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement