Advertisement

Advertisement

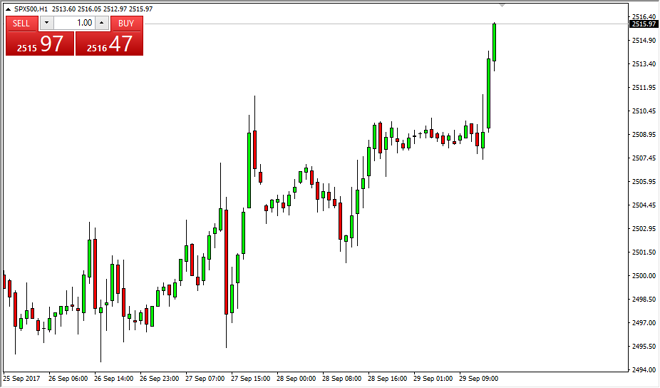

S&P 500 Price Forecast October 2, 2017, Technical Analysis

Updated: Oct 1, 2017, 08:20 GMT+00:00

The S&P 500 rally during the day on Friday as per usual, as the algorithmic traders continue to jump back into this market. I think the short-term

The S&P 500 rally during the day on Friday as per usual, as the algorithmic traders continue to jump back into this market. I think the short-term dips continue to be buying opportunities, and I will treat them as such. The 2500 level underneath should be a floor, which extends down to the 2490 handle. A breakdown below the 2490 handle would be very negative for the market, but I just don’t see it happening. I’ve noticed that every time this market starts to sell off, algorithmic traders command and flood the market with by orders. I think that will continue to be the way, as we enter the fourth quarter which tends to be very bullish overall anyway.

S&P 500 Video 02.10.17

I have a target of 2525 next, and then eventually the 2550 level. I think that the market may have down days for occasionally, but those should be looked at as value. After all, every time this market has dipped as of late we have seen buyers come back and jump all over it. Corporate earnings are good, and we do have earnings season coming up relatively soon which could provide more fuel for the fire. I have no interest in shorting this market, at least not until we break down below the 2400 level, which is far away from present levels. With this, I believe that the S&P 500 will continue to lead other US stock indices higher, just as the NASDAQ 100 did previously. This is a market that continues to see plenty of reason to go higher, and if we get some type of tax reform out of Washington DC, it will become absolutely turbocharged. Under those circumstances, we have just seen the beginning of where this market can go. The S&P 500 is extraordinarily bullish for my money.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement