Advertisement

Advertisement

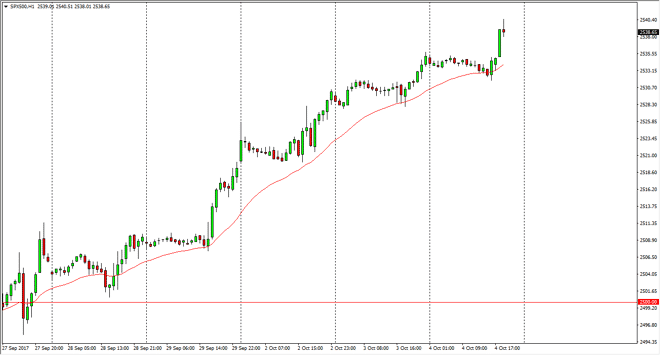

S&P 500 Price Forecast October 5, 2017, Technical Analysis

Updated: Oct 5, 2017, 05:34 GMT+00:00

The S&P 500 went sideways during most of the session on Wednesday but then shot towards the sky as we reached as high as 2540 in the CFD market. We

The S&P 500 went sideways during most of the session on Wednesday but then shot towards the sky as we reached as high as 2540 in the CFD market. We found a bit of resistance there, but that’s not overly surprising after such an impulsive move. If we drop from here, it’s likely that we will find support near the 2533 level, and therefore think it’s only a matter of time before we buy. Given enough time, I think that we break out towards the 2550 handle, which is a large and round psychologically important number. I think that buying dips will continue to be the best way going forward, as the market should offer value on these pullbacks. The market should continue to see a lot of noise, but quite frankly we have a significant amount of automated trading picking up the S&P 500 every time it drops. I think this continues, because quite frankly it’s been working for most hedge funds.

The significance of 2550

The significance of 2550 should be known, as it is a large, round, psychologically significant number but at the end of the day there’s nothing important there. I think that we will break above there, and that the pullback will be a nice buying opportunity, and then we should reach towards the 2600 level. I believe that the 2500 level underneath will continue to be the “floor” in the market, and I think it is now in our rearview mirror. Given enough time, we should continue to see buyers based upon the algorithmic approach, and of course earnings season which is coming soon. With this, I remain bullish of the S&P 500, as we have seen a bit of a sector rotation out of the tech sector and into other fields.

S&P 500 Video 05.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement