Advertisement

Advertisement

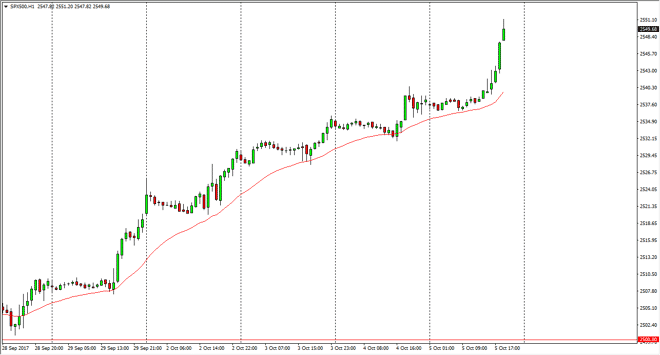

S&P 500 Price Forecast October 6, 2017, Technical Analysis

Updated: Oct 6, 2017, 06:07 GMT+00:00

The S&P 500 rallied significantly during the Thursday trading session as the 24-hour exponential moving average continues to offer support. We have

The S&P 500 rallied significantly during the Thursday trading session as the 24-hour exponential moving average continues to offer support. We have now reached towards the psychologically significant 2550 handle, which is an area that of course attract a lot of attention. At this point, I would anticipate that the market could pull back, but that should be a buying opportunity as we obviously have a lot of buying pressure underneath. I also believe that the 2440 level is going to offer a short-term floor, and I think that selling is all but impossible. When the market rolls over, you should be thinking about the value that is presented itself in that situation.

Longer-term, I anticipate that the market is going to go looking towards the 2600 level, and then eventually 3000 sometime next year. Obviously, that’s a longer-term outlook, but I think that dips continue to offer value that people will be taking advantage of. The 2500 level underneath should be the bottom of the uptrend, and if we can stay above there we should continue to enjoy bullish pressure. We are heading towards earnings season again, so the markets may slowdown soon, but I think it’s only a matter of time before we get better economic numbers that continue to propel this market to the upside. After all, most economic announcements have been healthy and as the markets rotate out of technology and into industrials and financials, the S&P 500 should continue to do quite well. Stock markets around the world continue to rally, the S&P 500 of course won’t be any different as we have started to see even more buying pressure in a market that simply cannot be sold. This is a rally that continues to defy gravity.

S&P 500 Video 06.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement