Advertisement

Advertisement

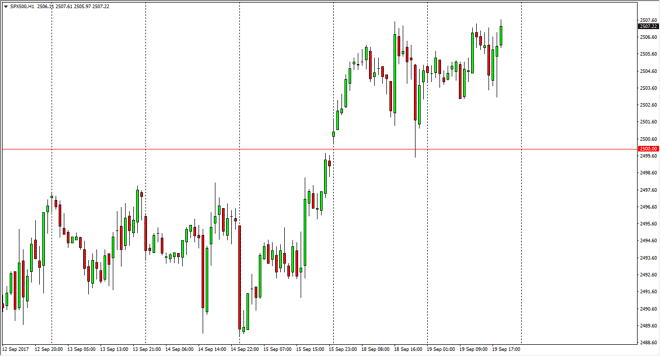

S&P 500 Price Forecast September 20, 2017, Technical Analysis

Updated: Sep 20, 2017, 07:15 GMT+00:00

The S&P 500 had a choppy session on Tuesday again but broke higher before it was all said and done. This makes sense because quite frankly I feel that

The S&P 500 had a choppy session on Tuesday again but broke higher before it was all said and done. This makes sense because quite frankly I feel that the Federal Reserve will sound very dovish today, and that should give the market the go-ahead for more bullish pressure going forward as cheap money continues to flow. I think that pullbacks offer to buy opportunities and that the 2500 level should offer support as it offered such resistance previously. Short-term pullbacks are value opportunities waiting to happen, and I believe that breaking above the 2500 level was a significant breakout that will have ramifications longer term. Most of the market thinks that the Federal Reserve cannot raise interest rates after the damage of hurricanes, and yet another one coming. The markets are expecting at the very least for the Federal Reserve to stand on the sidelines, and that should be enough to keep the liquidity flowing into the markets.

You cannot fight the Fed

You cannot fight the Federal Reserve, that’s one of the oldest axioms in the markets. As they are looking to keep the markets primed, they should continue to go higher. Quite frankly, they don’t have any other play in their arsenal. It seems as if the markets are betting on low interest rates for the long term, and quite frankly some Federal Reserve officials have hinted that the “normalization” of federal funds rates could be closer to the 2% level, not the 5% level that we had seen before the financial crisis. Because of this, money should continue to be cheap, and thereby allow for asset bubbles to continue to blowup everywhere. While there should be some type a significant pullback in the stock market, it doesn’t look like it’s happening anytime soon.

S&P 500 Video 20.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement