Advertisement

Advertisement

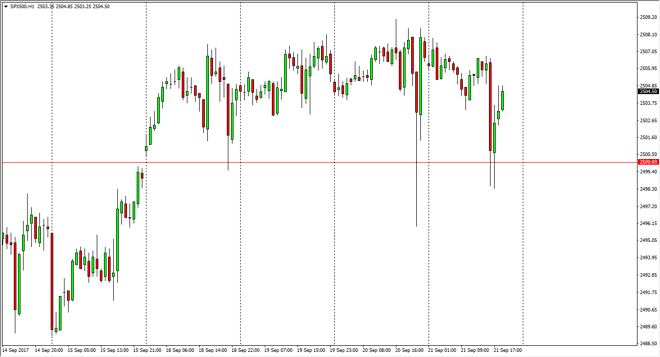

S&P 500 Price Forecast September 22, 2017, Technical Analysis

Updated: Sep 22, 2017, 06:49 GMT+00:00

The S&P 500 fell a bit during the day initially on Monday, dropping down to the 2500 level. The 2500 level offered enough support to turn around and

The S&P 500 fell a bit during the day initially on Monday, dropping down to the 2500 level. The 2500 level offered enough support to turn around and cause the market abounds, this is an area that has previously been resistive, and there is a gap in this general vicinity, that continues to hold the market higher. I think eventually will break out to the upside, as the market has come back around to the idea of the Federal Reserve shrinking its balance sheet, and that it may not be the end of the world. Ultimately, the market probably goes looking for the 2525 handle, which of course is resistive. On the other hand, if we were to break down below, that would be a very negative sign but I still think that there’s plenty of support below at the 2490 handle after that.

Volatility

The volatility in this market will probably continue because there’s concerns about the Federal Reserve, and is likely that the market will continue to be on the forefront of thought. Ultimately, I think that the market should continue to be difficult to deal with, and I believe that choppiness will continue. I think that short-term trading will probably continue to be the way going forward, unless of course you can trade options. For myself, I’ve been training options for some time, as this takes out some of the concerns of volatility. Longer-term though, I still believe that the path of least resistance is higher, not lower. Longer-term, the market should continue to see noise going forward, as the markets continue to “climb the wall of worry.” Caution will be advised, and small positions probably what will be necessary if you have to trade the spot CFD market.

S&P 500 Video 22.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement