Advertisement

Advertisement

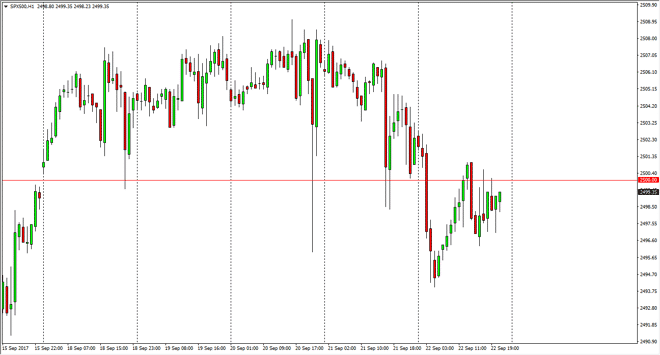

S&P 500 Price Forecast September 25, 2017, Technical Analysis

Updated: Sep 23, 2017, 07:06 GMT+00:00

The S&P 500 fell rather significantly at the open on Friday, but bounced enough to close with some semblance of stability. The 2500 level has been

The S&P 500 fell rather significantly at the open on Friday, but bounced enough to close with some semblance of stability. The 2500 level has been important in the past, and the fact that we are closing near it is a good sign. If we can break above the 2505 level, the market should continue to go much higher. I don’t have any interest in shorting this market, because we are in a longer-term uptrend. If we were to break down below the 2490 level however, that would be a negative sign. In the meantime, I look at these dips as buying opportunities in a market that has been strong for quite some time in the past. I think that ultimately, the market will continue to find buyers on dips as they have continued to offer value.

Ultimately, this is a market that I think will have a lot of volatility built in, because there is a lot of uncertainty when it comes to what’s going on around the world this market continues to go higher in the face of all bad news it seems, so therefore the only thing you can do is simply follow along with the overall trend. I believe that eventually we will go looking towards the 2025 level, and then 2550. Stock markets in general look to be doing quite well, and the S&P 500 won’t be any different. With all of that in mind, I find that the 2500 level is simply going to be a fulcrum of price, a magnet if you will. I think given enough time though, the 2500 level will be stripped of its psychological importance, and therefore won’t be such a big deal to leave it in the past and behind us.

S&P 500 Video 25.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement