Advertisement

Advertisement

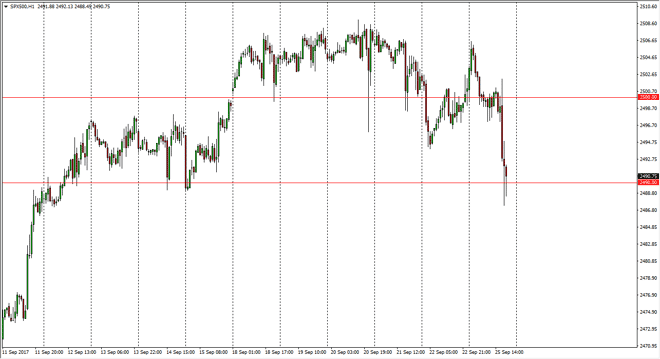

S&P 500 Price Forecast September 26, 2017, Technical Analysis

Updated: Sep 26, 2017, 07:24 GMT+00:00

The S&P 500 initially tried to rally on Monday, but then turned around to fall significantly. We reach down to the 2490 level, an area that has been

The S&P 500 initially tried to rally on Monday, but then turned around to fall significantly. We reach down to the 2490 level, an area that has been supportive, and I think that the hourly candles that have been forming just above that level suggest that we are going to continue to find buyers on dips. I like buying the S&P 500, and I believe that we will go looking towards the 2500 level next. If we can clear that level, the market should continue to go much higher, perhaps the 2525 level. I do believe that the overall attitude of the market is to go higher, and even though we had comments coming out of North Korean officials during the day that spoke the market, in the end, it is likely that the pullback has been short-lived and short-term only. The markets should continue to find a reason to go higher, and even though the Federal Reserve looks likely to raise interest rates and of course shrink the balance sheet.

S&P 500 Video 26.9.17

Volatility continues, but I believe in the end that there isn’t much to keep this market down in the short term. I believe that the market will eventually reach much higher, but there are a lot of concerns geopolitically. However, there really isn’t much to keep this market down from what I can see, mainly because of the overall “buy the dips” attitudes. Ultimately, this market will look back at the 2500 level as an area that attracted a lot of attention, but should eventually be a “floor” in the market. The market breaking down below the 2450 level would be very negative, but I don’t see that happening anytime soon. I continue to buy for short-term moves, and eventually above the 2510 level will be looking for longer-term “buy-and-hold” scenarios.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement