Advertisement

Advertisement

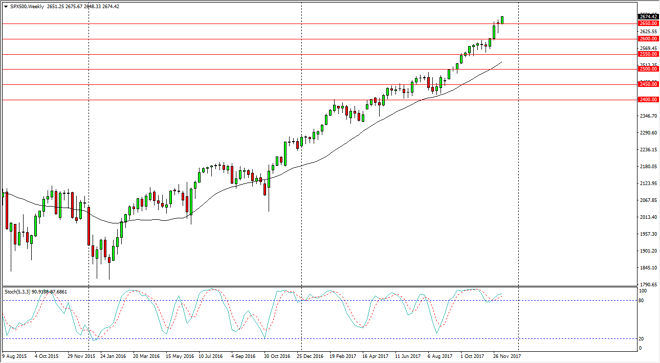

S&P 500 Price forecast for the week of December 18, 2017, Technical Analysis

Updated: Dec 16, 2017, 05:06 GMT+00:00

The S&P 500 broke down during the week, breaking above the top of the hammer from the previous week, which of course is a sign that we are ready to continue to see a bullish market. I think at this point, 2700 is an obvious target.

The S&P 500 rallied during the week, breaking above the top of the hammer from the previous week. Because of this, it looks as if we are ready to go to the 2700 level above, probably this week. We are continuing to see “the Santa Claus rally”, which is money managers jumping into the market as an attempt to pad gains for the year continues. By showing clients that they are making gained swords in the year, it’s a way to keep money in your accounts. I think at this point, the 2600 level underneath is support, and I would be surprised to see this market break down below that level, not to mention the 2550 handle. I think if we stay above the 2550 level, we will continue to find plenty of reasons to go higher.

2700 is the next obvious target, but I think sometime early next year we will probably be looking at a move towards the 3000 handle. This is a market that has picked up a bit of momentum, and therefore I think we are starting to see the markets come to grips with the idea of a tax bill perhaps helping corporate gains, and that of course will show itself in the S&P 500. Beyond that, it looks as if the US dollar is starting to fall a bit more, and that should have more risk-taking as a side effect as the Euro, New Zealand dollar, British pound, and several other currencies look healthier than the greenback.

S&P 500 Video 18.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement