Advertisement

Advertisement

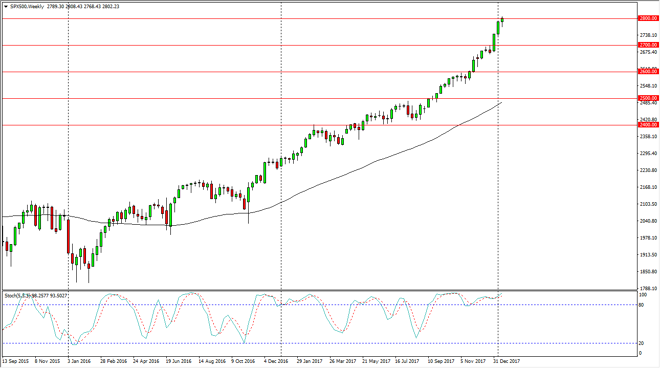

S&P 500 Price Forecast for the Week of January 22, 2018, Technical Analysis

Updated: Jan 21, 2018, 09:37 GMT+00:00

The S&P 500 initially fell during the week, but turned around to form a bit of a hammer. The hammer sits just below the 2800 level, so I think if we can break above the top of this hammer, it will show a need to explode to the upside. You could in fact be a bit of a “blow off top.”

The S&P 500 initially fell during the week, but then rallied to form a massive hammer. The market is starting to get a bit ahead of itself though, so I think a pullback could be necessary. If we break above the top of the hammer, we could begin to see a bit of a “blow off top”, which would be a very negative sign eventually. I would much prefer to see some type a pullback underneath the hammer begin to bring and sellers, as it would give us a bit of value in a market that has broken out far too stringently. I think that the 2700 level underneath will be massively supportive, and I would love to buy the S&P 500 at that level.

I do believe that longer-term we are going to go looking towards the 3000 level, but it may take some time to get there. If we get there too quickly, that could be the end of the rally, at least for the near future. I think there are plenty of reasons for the stock market to continue going higher, but I also recognize that we have gotten far too ahead of ourselves, and it’s likely that we will struggle as a result. It certainly would be difficult to short this market, I just would stand out-of-the-way if we get an explosive move higher.

S&P 500 Video 22.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement