Advertisement

Advertisement

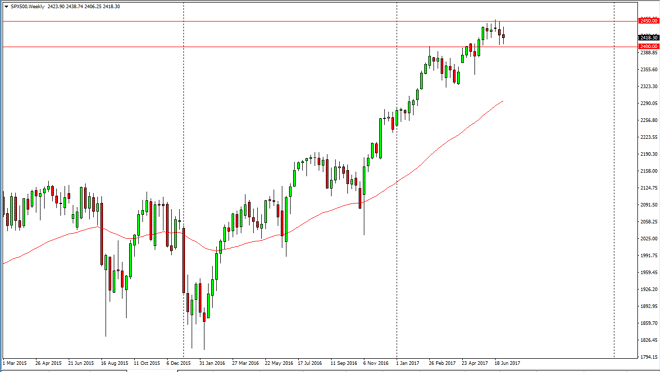

S&P 500 Price Forecast for the Week of July 10, 2017, Technical Analysis

Updated: Jul 9, 2017, 07:15 GMT+00:00

The S&P 500 had a choppy week, as we trying to break above the 2450 level but failed, only to fall towards the 2400 level and find more buyers. The

The S&P 500 had a choppy week, as we trying to break above the 2450 level but failed, only to fall towards the 2400 level and find more buyers. The jobs number was stronger than anticipated, so that should continue to give a bit of a boost to the market although there will be fears about interest rates rising. Nonetheless, I do like the longer-term uptrend, and I believe that the resiliency shown on Friday should send this market to the upside overall. I think that the 2400 level offer support, and that the buyers will be interested as we approach that level. If we break above the 2450 handle, I think we then go looking for the 2500 level which has been my longer-term target for some time.

Earnings season

Earnings season had been very good for the S&P 500, so I think it’s only a matter of time before the buyers reflect that. We may have to grind sideways in general though, because quite frankly the market had risen so much. Nonetheless, I think that longer-term the S&P 500 will not only reach towards the 2500 level, but break above there as well. All of this being the case, I think that a “buy on the dips” mentality still exists when it comes to the S&P 500, and therefore I don’t have any interest in shorting, least not until we break down below the 2350 level, which would be a sliced through a gap that had already been filled below. Expect volatility, but I still expect a certain amount of upward pressure overall, and will add to my position very slowly as I think the volatility continues to be very real in the markets overall.

S&P 500 Video 10.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement