Advertisement

Advertisement

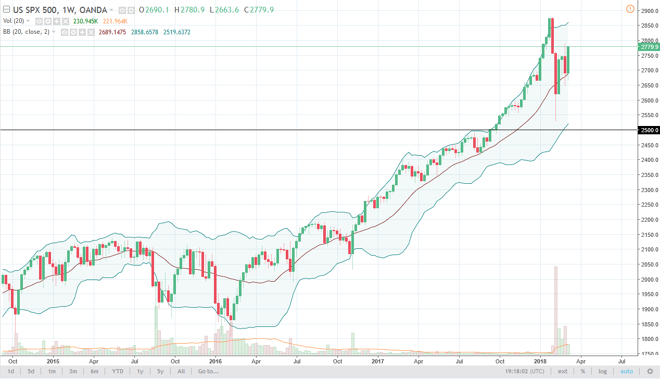

S&P 500 Price forecast for the week of March 12, 2018, Technical Analysis

Updated: Mar 10, 2018, 07:01 GMT+00:00

The S&P 500 initially fell during the week but found enough support underneath to turn things around and send this market to the upside. The 2800 level above is a potential resistance barrier, but if we break above there I think we continue to go to fresh, new highs.

The S&P 500 pulled back a little bit during the week, but then exploded to the upside, reaching towards the 2800 level. If we can break above there, the market should continue to go higher, to at least the 2875 handle. If we were to break above that level, then the market goes looking towards the 3000 level. Ultimately, I think that every once in a while, we pull back, but that should offer value that people are willing to take advantage of. I believe that the 2500 level underneath is a “floor” in the market, so it’s likely that if we break down below there this market will collapse. I think that value hunters will continue to pick this market up every time it pulls back and show signs of support, and I also believe that eventually we will go higher. I think that it’s volatile, but if you are cautious and add slowly you can take advantage of the momentum.

Ultimately, I believe that this market will eventually get clarity, but in the meantime, there are a lot of issues that we will need to address, and that may cause a bit of shakeout occasionally. Trade tariffs and potential trade wars could move this market around, just as the occasional headline coming out of geopolitical concerns could. Ultimately, I believe that we are going to continue to see noise, but in the end, it should continue to offer an opportunity for us to rally.

S&P 500 Video 12.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement