Advertisement

Advertisement

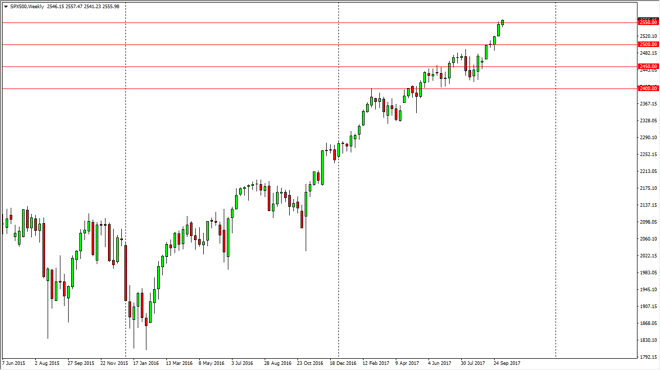

S&P 500 Price forecast for the week of October 16, 2017, Technical Analysis

Updated: Oct 15, 2017, 07:15 GMT+00:00

The S&P 500 rallied during the week, slicing above the 2550 level, and showing significant strength because of that. I believe that it’s only a matter

The S&P 500 rallied during the week, slicing above the 2550 level, and showing significant strength because of that. I believe that it’s only a matter of time before the rally, although we are starting to get a little bit on the parabolic side now. I think that pullbacks are healthy, and I think that there should be a significant amount of support at the 2500 level. Longer-term traders are looking for value to take advantage of, as they have more than once over the last couple of years. I believe that the 2400 level underneath is the bottom of the uptrend, so it’s not until we break down below there that I would be concerned about the longer-term move. I recognize the volatility will remain high on the short-term charts, so those of you who are looking to benefit from the longer-term trend, this might be a good market to do so. Personally, I am long the SPY ETF from to go and continue to jump into the options market, selling puts.

S&P 500 Video 16.10.17

I would also suggest that perhaps the CFD market might be the place to go because then you can keep your position size small enough that you can add on pullbacks to bring your position size in line with the totality of the move, and profit significantly from the obvious strong uptrend. I have no interest in shorting unless we break down below the 2400 level, and that doesn’t look likely. If it did, then I think I would probably become a bit more aggressive. I have a target of 2600, but I think it may take 6 or more weeks to get there. Certainly, earnings season could change everything, so be aware of that.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement