Advertisement

Advertisement

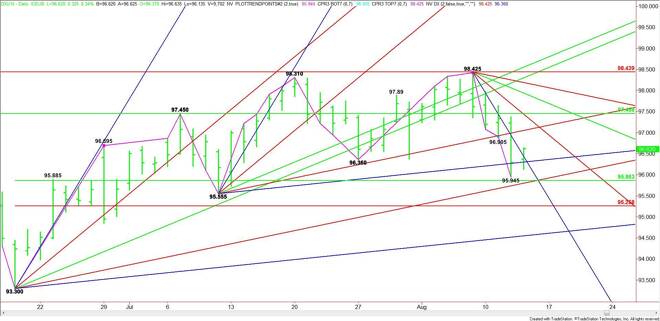

US Dollar Index (DX) Futures Technical Analysis – August 13, 2015 Forecast

By:

Despite a third intervention by the People’s Bank of China early Thursday, September U.S. Dollar futures rallied, suggesting the currency markets had

Despite a third intervention by the People’s Bank of China early Thursday, September U.S. Dollar futures rallied, suggesting the currency markets had stabilized after two days of high volatility.

Technically, the main trend turned down on the daily chart on Wednesday when the index took out the previous main bottom at 96.36.

The selling pressure subsided at 95.945 when the index approached the major 50% level at 95.86. Besides this level, additional support today is an uptrending angle at 95.80, a main bottom at 95.555 and a Fibonacci level at 95.26.

Today’s early session rally began when the index overcame an uptrending angle at 96.31 and a downtrending angle at 96.43.

A sustained move over 96.43 could trigger an acceleration to the upside with the next target another uptrending angle at 97.06 and a downtrending angle at 97.43.

The angle at 97.43 forms a tight resistance cluster with a major 50% area ta 97.46, making 97.43 to 97.46 the best upside target today.

Based on the pre-market trade, look for a bullish tone today on a sustained move over 96.43 and a bearish tone today on a sustained move under 96.31.

Look for volatility at 8:30 a.m. ET, following the release of today’s U.S. Retail Sales report. Traders expect Core Retail Sales to come in at 0.4%. Retail Sales are expected to come in at 0.6%.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement