Advertisement

Advertisement

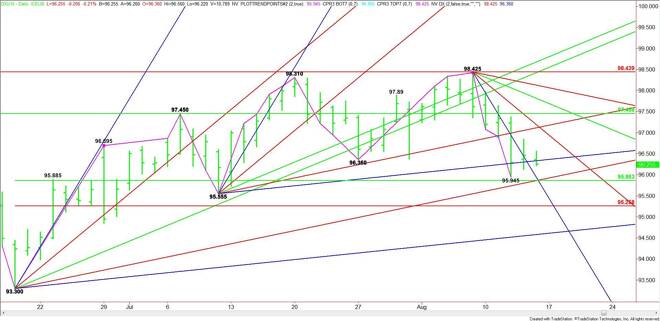

US Dollar Index (DX) Futures Technical Analysis – August 14, 2015 Forecast

By:

September U.S. Dollar Index futures are trading slightly lower shortly before the cash market opening. For the second consecutive day, the market is

September U.S. Dollar Index futures are trading slightly lower shortly before the cash market opening. For the second consecutive day, the market is trading inside Wednesday’s wide range. The range bound trade makes it look like momentum may be changing to the upside, however, the price action suggests sellers may just be waiting to resume the down move.

The main trend is down according to the daily swing chart. The index is also straddling an uptrending angle at 96.34. This angle is controlling the direction of the market today.

A sustained move under 96.34 will signal the presence of sellers. This could trigger a fast break into a cluster of numbers 95.93 to 95.86. An uptrending angle and a Fibonacci level form the best downside target at 95.86.

The cluster at 95.86 is also a trigger point for an acceleration to the downside with the Fibonacci level at 95.26 the next likely downside target.

Crossing back over to the strong side of the uptrending angle at 96.34 will signal the presence of buyers. This could create enough upside momentum to trigger an acceleration to the upside with the next major target coming in at a resistance cluster at 97.12 to 97.18.

Watch and read the price action and order flow at 96.34. This will tell us whether the bulls or the bears are in control.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement