Advertisement

Advertisement

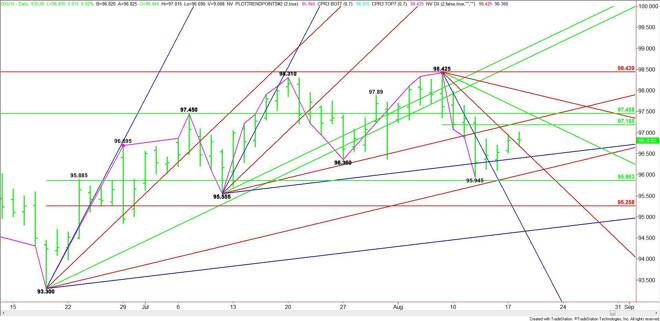

US Dollar Index (DX) Futures Technical Analysis – August 18, 2015 Forecast

By:

September U.S. Dollar Index futures are trading flat in the pre-market session. The market appears to be consolidating after last week’s volatile

September U.S. Dollar Index futures are trading flat in the pre-market session. The market appears to be consolidating after last week’s volatile sessions, but with a slight upside bias. The main trend is down according to the daily swing chart, however, momentum appears to be to the upside.

The short-term range is 98.425 to 95.945. Its 50% level or pivot is 97.185. This price is controlling the short-term direction of the market.

Based on the pre-market trade, the downtrending angle at 96.68 is also influencing the direction of the market. A sustained move over the angle could fuel a rally into the pivot at 97.185. Overcoming this level and an uptrending angle at 97.24 will indicate the buying is getting stronger. This could drive the market into a major 50% level at 97.46 and downtrending angle at 97.55.

A break back under the downtrending angle at 96.68 will signal the presence of sellers. This could trigger a move into the next uptrending angle at 96.40. This level is also a trigger point for a steep sell-off into a long-term uptrending angle at 95.99, the low at 95.945 and a major 50% level at 95.86.

Based on the current price at 96.83, look for a bullish tone to develop on a sustained move over 96.68 and a bearish tone to develop on a sustained move under this price. On the upside, the next major pivot to deal with comes in at 97.185. This could affect not only today’s session, but the near-term direction of the market also.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement