Advertisement

Advertisement

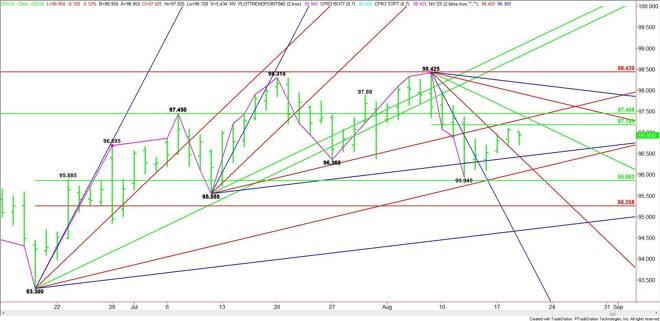

US Dollar Index (DX) Futures Technical Analysis – August 19, 2015 Forecast

By:

September U.S. Dollar Index futures are trading slightly lower during the pre-market session. Volume is light and the range is tight ahead of the release

September U.S. Dollar Index futures are trading slightly lower during the pre-market session. Volume is light and the range is tight ahead of the release of the U.S. consumer inflation report at 8:30 a.m. ET.

The main trend is down according to the daily swing chart. The short-term range is 98.425 to 95.945. Its mid-point or pivot at 97.185 is controlling the short-term direction of the market. Trader reaction to this level will tell us whether the bulls or the bears are in control.

A sustained move over 97.185 will signal the presence of buyers. The first target is a price cluster at 97.43 to 97.46. This area is also a potential trigger point for an upside breakout. The next two targets are downtrending angles at 97.93 and 98.18. The latter is the last angle before the 98.425 main top and the major Fibonacci level at 93.44.

Taking out 93.44 with conviction will change the main trend to up. This could generate further upside momentum.

A failure to overcome 97.185 will indicate the presence of sellers. The first downside target is a pair of angles at 96.43. Look for a technical bounce on the first test of this level. It is also a potential trigger point for an acceleration to the downside with potential targets at 96.05, 95.945 and 95.86.

The downtrend will resume under 95.945 and the market is likely to accelerate if 95.86 is taken out with conviction with the next major target coming in at 95.26.

Watch the price action and read the order flow at 97.185 today. Look for volatility after the release of the CPI number at 8:30 a.m. ET. Volatility may return at 2:00 p.m. ET with the release of the latest Fed minutes.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement