Advertisement

Advertisement

US Dollar Index (DX) Futures Technical Analysis – August 24, 2015 Forecast

By:

Last week, September U.S. Dollar Index futures finished lower for the second week in a row as stocks plummeted, driving up volatility and forcing

Last week, September U.S. Dollar Index futures finished lower for the second week in a row as stocks plummeted, driving up volatility and forcing investors to reevaluate their expectations of an early rate hike by the U.S. Federal Reserve.

For several months, monetary divergence had been driving the U.S. Dollar higher as investors increased bets that the Fed would raise rates in September for the first time since 2006. The minutes from the July Fed meeting sent a mixed message to investors last week, however. The volatility on Friday caused by China’s weak manufacturing activity report triggered a huge sell-off in global equity markets that is expected to carry over into today’s session.

The devaluation of the Yuan two weeks ago, the sell-off in U.S. equities and falling crude oil prices have caused investors to question whether the Fed will raise interest rates at all this year. These events are encouraging speculators to dump the U.S. Dollar.

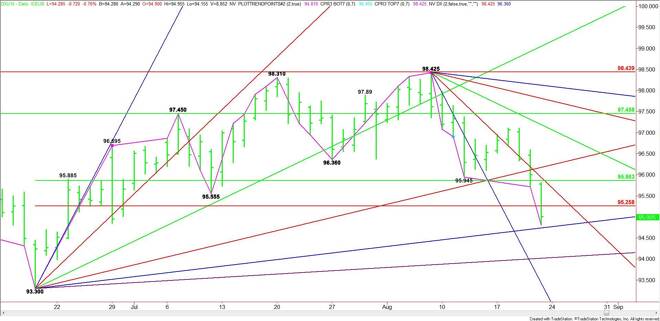

Technically, the main trend is down on the daily chart. The main range is 93.30 to 98.425. Friday’s close was below its retracement zone at 95.86 to 95.26, putting the market in a weak position.

If the selling continues then look for traders to go after the uptrending angle at 94.77. Taking out this angle is likely to trigger an acceleration to the downside with the next target an uptrending angle at 94.03. This is the last major angle before the 93.30 main bottom.

Overcoming the Fibonacci level at 95.26 will signal the presence of buyers, driving the market into a downtrending angle at 95.68 or the 50% level at 93.86. Don’t expect an acceleration to the upside until the uptrending angle at 96.24 is taken out with conviction. The main target over this level is a downtrending angle at 97.05.

Momentum is clearly to the downside based on Friday’s weak close and strong volatility. Look for the selling pressure to continue on a sustained move under 94.77. A bullish tone could develop on a sustained move over the Fib level at 95.26.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement