Advertisement

Advertisement

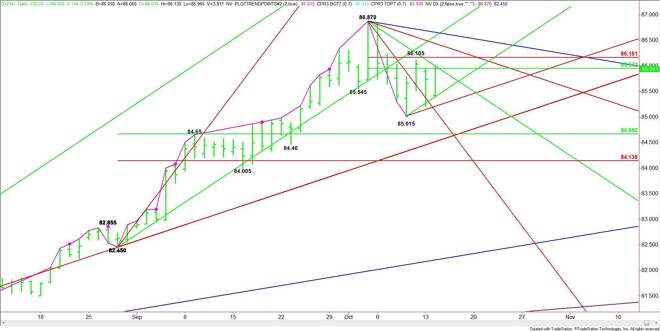

US Dollar Index (DX) Futures Technical Analysis – October 15, 2014 Forecast

By:

The price action by the December U.S. Dollar Index is starting to suggest bottoming. Once again the market survived an attempt to take out the 85.015

The key support angles come in at 85.52 and 85.27. A failure to hold 85.27 could encourage selling pressure down to the minor bottom at 85.015. Taking out this level with conviction could lead to a completion of a retracement into 84.66 to 84.14.

The short-term range is 86.87 to 85.015. Its retracement zone at 85.94 to 86.16 is currently providing resistance. A downtrending angle at 85.87 is also a potential resistance level. Overtaking the 50% level at 85.94 could trigger an acceleration into the Fibonacci level at 86.16.

The rally over 86.16 could lead to a further upside action into downtrending angles at 86.37 and 86.62. The angle at 86.62 is the last potential resistance before the main top and contract high at 86.87.

The tone of the market today will be determined by trader reaction to the 50% level at 85.94.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement