Advertisement

Advertisement

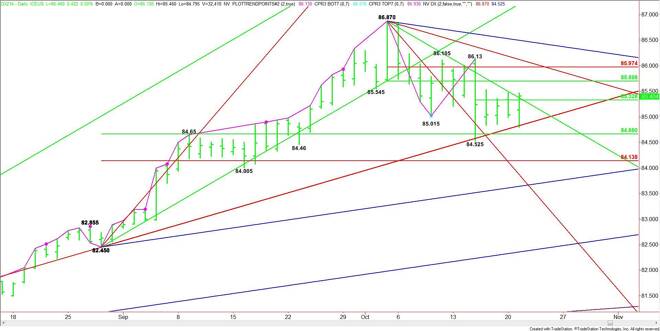

US Dollar Index (DX) Futures Technical Analysis – October 22, 2014 Forecast

By:

The December U.S. Dollar Index broke early in the session on Tuesday only to find support on a long-term uptrending angle at 84.795. Today, this angle

The main range is 82.45 to 86.87. The retracement zone formed by this range is 84.66 to 84.14. This zone stopped the break last week when the market traded down to 84.525. If the angle at 84.89 fails then look for a drive back into this zone.

The short-term range is 86.13 to 84.525. Its pivot at 85.33 is controlling the short-term direction of the market. The close above this pivot gives the index an upside bias from the opening on Wednesday.

The index also closed on the bullish side of a key downtrending angle from the 86.87 top, indicating developing strength. This angle drops in at 85.25 today. A sustained move over this angle could drive the market into the next retracement zone at 85.70 to 85.97. Another target is a downtrending angle from the 86.87 top at 86.06.

The tone of the market today will be determined by trader reaction to the pivot at 85.33. Holding above this price could create enough upside momentum to challenge the 50% level at 85.70.

Breaking under 85.33 will be a sign of weakness, but don’t expect any hard selling unless the index crosses to the bearish side of the downtrending angle at 85.25.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement