Advertisement

Advertisement

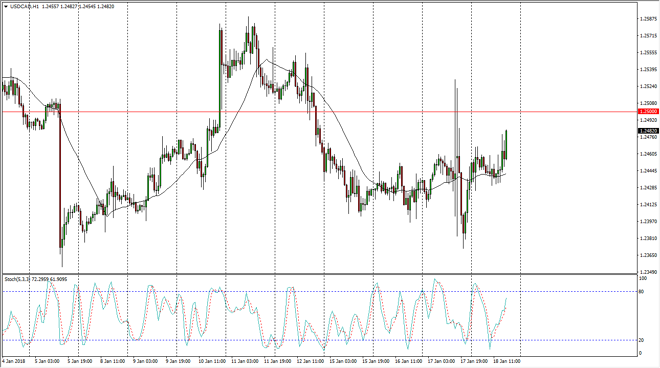

USD/CAD Price Forecast January 19, 2018, Technical Analysis

Updated: Jan 19, 2018, 05:47 GMT+00:00

The US dollar has been very noisy against the Canadian dollar, and after the interest rate hike from Ottawa yesterday, it makes sense that we will continue to see quite a bit of volatility.

Although the Bank of Canada raised interest rates yesterday, the reality is that they are going to be hard-pressed to do so rapidly. As we rallied during the day on Thursday, it looks as if the 1.25 level is being targeted. A break above there is bullish it has the market looking for the 1.2575 handle next. If we pull back from here, the market should then go looking towards the 1.24 handle underneath, which has been supportive. A breakdown below that level is almost certainly going to see the market go looking towards the 1.21 handle underneath, followed very quickly by the 1.20 level which is a major support barrier.

I believe that this market continues to be very volatile, because there is weakness in the US dollar, but also concerned about the Canadian economy, especially the housing market. Oil of course has its say, and if oil can rally, that should send this market lower. Of course, the opposite is true as well. One should not take the oil correlation too seriously though, and think of it as a mere suggestion. After all, the United States supplies a massive amount of crude oil to itself these days.

In the meantime, if we cannot break above the 1.25 level, then I think we just stay within the consolidation that we have seen. Market participants should be very leery, and trade small positions. This pair is going to be very noisy as money seems to be flowing from North America to Europe and other destinations around the world.

USD/CAD Video 19.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement