Advertisement

Advertisement

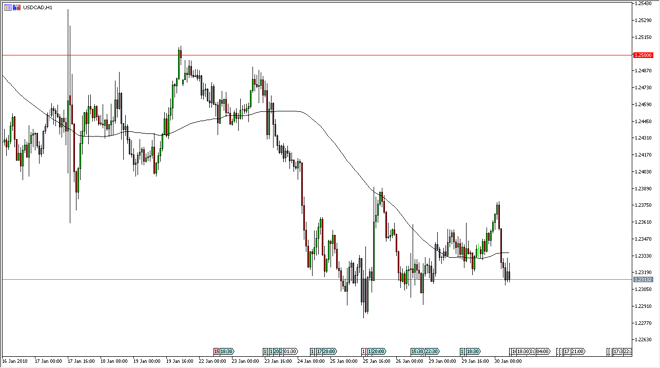

USD/CAD Price Forecast January 31, 2018, Technical Analysis

Updated: Jan 31, 2018, 04:45 GMT+00:00

The US dollar has fallen significantly against the Canadian dollar during the trading session on Tuesday, as we continue to see a lot of volatility in the crude oil markets. Remember, crude oil is a major driver of the Canadian dollar, so obviously that will have a lot to do with what happens next.

The US dollar has rolled over against the Canadian dollar during the trading session on Tuesday, breaking down towards the 1.23 handle. However, we are starting to see the market slow down a bit to the downside, so it’s likely that the market could bounce a bit. However, I think there’s an obvious amount of bearish pressure just above, and I think we will continue to go back and forth in general with a slightly negative proclivity. If we do break down below the 1.23 handle, then the market is free to go down to the 1.21 level, which is the beginning of massive support that extends down to the 1.20 level, which of course is a large, round, psychologically significant number.

The market breaking above the 1.24 level would be bullish, but I think there is a lot of noise extending to the 1.25 handle, so it’s probably not until we break above there that I will be putting money to work in buying this pair. Beyond that, I would need to see the US Dollar Index rally, as it would show an overall bullish pressure in the greenback, something that we have not seen as of late. Until then, I will of course favor the downside, but I also recognize that oil should help as well. If we get a rally in the oil markets, that should continue to be downward pressure on this market, but of course the opposite can happen. Pay attention to the US Dollar Index, the WTI Crude Oil market, and of course price action on this chart.

USD/CAD Video 31.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement