Advertisement

Advertisement

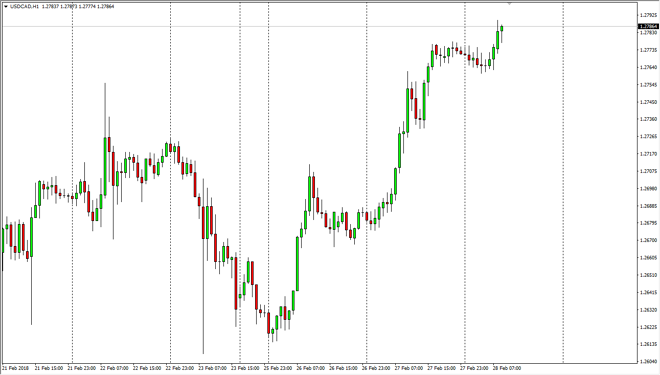

USD/CAD Price Forecast March 1, 2018, Technical Analysis

Updated: Mar 1, 2018, 06:21 GMT+00:00

The US dollar has rallied again against the Canadian dollar, breaking above the 1.2750 level handily, and continuing to the upside. I believe that this market is starting to go higher based upon several different reasons, so I am bullish.

The US dollar has rallied significantly during the trading session on Wednesday, as we continue the uptrend. Oil markets look very soft, so it’s likely that we will continue to see this market rally to the upside as well. I think that pullbacks should have plenty of support underneath, especially near the 1.2750 level. There is a lot of support under there as well, so I look at dips as buying opportunities, and it’s only a matter of time before value hunters come back. I believe that the Canadian dollar will suffer from lower oil pricing this year, and of course the Canadian housing bubble that I’ve been paying a lot of attention to in the Greater Toronto Area.

I think that the market continues to be very noisy, but that’s the norm for this pair as the economy is or so highly intertwined, and as the nations are the largest trading partners of each other, there is a lot of back and forth. I think that adding slowly on dips when the market works out for you is the best way to go, as there is very little in the way of reason to think that this market will break down with any significance.

Pay attention to the US bond markets, because if the interest rate situation continues to go higher, then it makes sense that we continue to go higher as well. While the US dollar has struggled against many other currencies, the Canadian dollar is a bit of a misnomer, as it is so highly leveraged to petroleum.

USD/CAD Video 01.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement