Advertisement

Advertisement

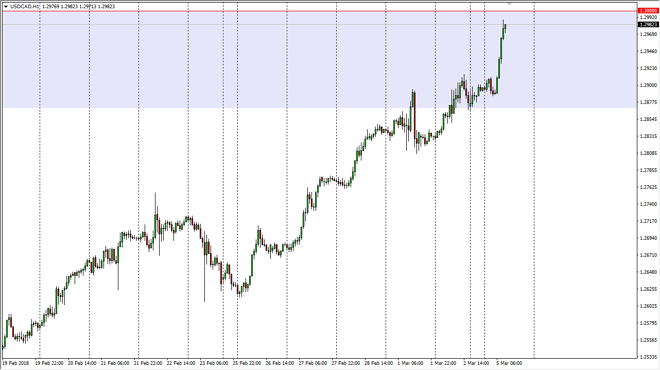

USD/CAD Price Forecast March 6, 2018, Technical Analysis

Updated: Mar 6, 2018, 05:22 GMT+00:00

The US dollar has exploded to the upside against the Canadian dollar during the trading session on Monday, reaching towards the vital 1.30 level. If we can break above that level, the market is free to go much higher. However, in the short term we may need to make several attempts to do so.

The US dollar has rallied significantly on Monday, reaching towards the 1.30 level against the Canadian dollar. This is an area that is very important when it comes to the longer-term outlook of the pair, and I recognize that there is a lot of noise above the 1.30 level that could cause issues. The noise above should be thought of as the next “accumulation phase” of this pair, as it does tend to move from one accumulation area to another. This makes sense, the economies in both the United States and Canada depend on each other quite heavily, so in turn the currencies tend to be very choppy against each other.

Pay attention to oil markets, as they fall over it will of course put upward pressure in this pair, and I think that will continue to be one of the bigger themes in the Forex markets, falling oil prices and rising US dollar rates against the Canadian dollar, Norwegian krone, and other currencies that are highly leveraged to petroleum. This market is the first place most traders will go to express their attitude with the oil markets, so it tends to react rather quickly. I believe that the Canadian dollar has several other issues as well, well beyond the oil, and that should have this market looking to hire rates over the next several months. I have no interest in shorting this pair, I believe that there should be significant support near the 1.28 handle.

USD/CAD Video 06.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement