Advertisement

Advertisement

USD/JPY forecast for the week of February 26, 2018, Technical Analysis

Updated: Feb 24, 2018, 04:18 GMT+00:00

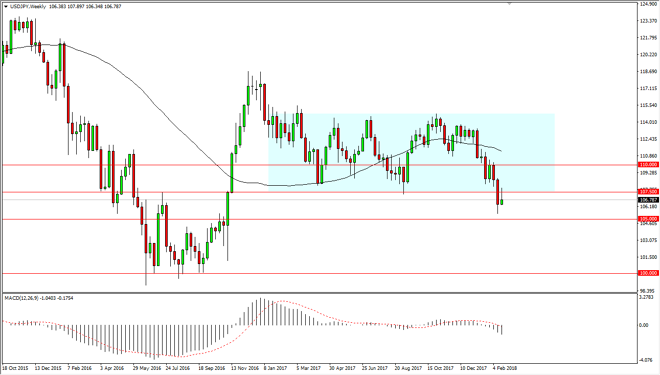

The United States dollar initially tried to rally during the week, but as you can see, gave back most of the gains, and ended up forming a bit of a shooting star, showing that the retest of the 107.50 level has occurred, and has found plenty of resistance.

The US dollar has rally during the week, breaking towards the 107.50 level. That’s an area that was previous up or, and it now has shown itself to be resistive. Because of this, I think that the market forming a shooting star is telling us that it could very easily drop down towards the 105 region. That’s an area that should bring a lot of support and interest, as we have seen a lot of noise just below that level. If we were to break down below the 105 handle, we could be talking about going back to the 100 handle again. It will be very interesting so what happens next, because I think this market will probably try to get down there, but obviously it will be noisy occasionally. Because of this, I suspect that it’s easier to trade this market on short-term charts, and as you can see the markets look very noisy. I think that the 105-level underneath will of course cause a lot of pushback, but I believe that the breakdown below the 107.50 level signified that there was a shift in attitude.

U.S. Treasury markets have been selling off, and that drives the value of the dollar lower in this market, as it is highly correlated to the 10-year note. Ultimately, this is a market that should continue to be noisy, so longer-term traders will probably be best suited to avoid the weekly charts.

USD/JPY Video 26.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement